TL;DR: The Moonbeam Foundation, following a study by Gauntlet, proposes the following change to the tokenomics of Moonriver:

- Redirect 80% of the Parachain Bond Reserve (PBR) inflation to the Moonbeam Treasury to fund ecosystem operations.

This change is to be voted on through governance.

Abstract

Back in July, the Moonbeam Foundation completed an engagement with Gauntlet to conduct a macroeconomics and tokenomics study in order to identify adjustments that could be made in order to promote the long term sustainability of the Moonriver and Moonbeam networks.

A number of levers were considered and ultimately, the recommendation was to direct 80% of the PBR (Parachain Bond Reserve) inflation to the Moonbeam Treasury to support ecosystem operational costs. Community Members were invited to provide feedback and many thoughtful responses were provided. Please see this forum post for all the details and the discussion.

One suggestion was to also increase the percentage of fees burned from 80% to 100% in order to create a deflationary force as transaction volume increases. Upon further review, it was determined this change wouldn’t impact the current sustainability modeling in a material way and could be included along with the change to the PBR inflation.

With the recent upgrade of Moonriver to RT3300, it is now possible to make the first change (ie. set a percentage of the PBR inflation to the treasury) via Governance without having to be done through a Runtime upgrade. This way, community members can vote on this important issue in isolation.

RT3500 will allow for making the second change (adjusting the percentage of fees that are burned vs directed to the treasury) via Governance.

This proposal is to alter the Moonriver protocol’s tokenomics to direct 80% of the PBR inflation to the Treasury.

Once RT3500 is enacted, a second proposal will be created to increase the percentage of fees burned from 80% to 100%.

Details

With regards to the PBR inflation change, recall that Moonriver’s inflation model targets 5% annual inflation and breaks down as follows:

- 1% to Collators (20% of inflation)

- 2.5% to users that stake and delegate MOVR to collators (50% of inflation)

- 1.5% to the parachain bond reserve (30% of inflation)

(See Moonriver Tokenomics for more details.)

In terms of real numbers, with a current total supply of approximately 11.61M MOVR, this will result in approximately 139K MOVR being added to the treasury in one year or 11.6K MOVR per month.

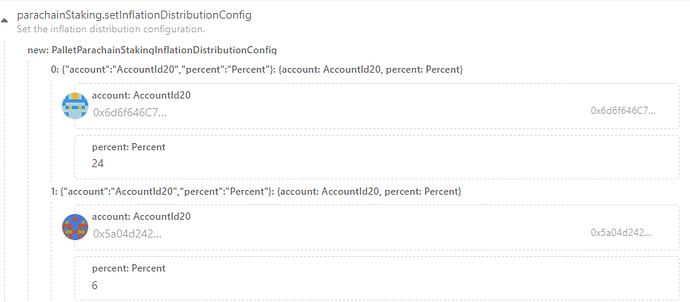

This proposal contains a transaction that uses the parachainStaking.setInflationDistribuitionConfig extrinsic to split where the PBR inflation is directed across two addresses. Despite the extrinsic’s name, it controls ONLY the 30% of inflation that makes up the parchain bond inflation.

Thus, the extrinsic is used to achieve the 80/20 split by configuring:

- 24% of inflation to the on-chain treasury address (0x6d6f646C70792f74727372790000000000000000)

- The remaining 6% of PBR inflation to the existing Parachain Bond Reserve address (0x5a04d242669eDF087Ab5e6829B10D9556F4020a3)

This change was tested on Moonbase Alpha and verified to have the desired effect.

A separate Proposal with the same change will be created on Moonbeam but timed so that this change has been live on Moonriver for at least 7 days before being enacted on Moonbeam.