Title - StellaSwap: Ecosystem Grant Draft Proposal

Author - StellaSwap

TLDR

-

Primary Goal- Maintain and Grow Activity (active users, transactions, TVL)

-

Secondary Goal- Building Connected Contracts Use Cases

-

Project Description - StellaSwap is a hybrid DEX that features a standard, stable and concentrated liquidity AMM to facilitate the most optimal price discovery for assets on Moonbeam

-

Requested GLMR Grant Amount - 2M GLMR

-

Use of Grant - The ecosystem grant will be used to sustain & deepen the market depth of strategic assets for widespread utility across the ecosystem

-

Motivation for Grant Amount- Liquidity depth is a necessary requirement for a robust and efficient marketplace that powers the ecosystem. StellaSwap accounts for 80%-90% of trading activity on the network and therefore, the continuation of grants would foster greater market depth via our newly-launched Pulsar + stable AMM and allow vital functions such as the liquidation of underwater loans to occur.

PROJECT OVERVIEW & TEAM EXPERIENCE

StellaSwap is a hybrid DEX that features a standard, stable and concentrated liquidity AMM to facilitate the most optimal price discovery for assets on Moonbeam. As the largest DEX and an integrated DeFi gateway, users can tap on a comprehensive list of features that simplifies their DeFi experience. Users can engage in trading, liquidity provisioning, bridging, cross-chain swaps, and a whole host of things.

We’re proud to be the only DEX on Polkadot that have surpassed over $1B in trading volume! We were the first DEX to go live on Moonbeam, and have been the prominent DEX ever since. At its peak, StellaSwap accumulated over $140M in TVL and had an average daily volume of around $3-$5M. StellaSwap has pioneered several novel mechanisms such as our Initial Liquidity Offering (ILO) to foster capital inflows towards Moonbeam, ZAP feature to facilitate 1-click staking, and we’ve launched the first concentrated liquidity AMM called Pulsar, which is the most capital efficient AMM to date.

StellaSwap was the only native DEX - and one out of two protocols - that received Moonbeam’s Level 3 grants previously to spearhead ecosystem growth. We’ve worked with key protocols such as Moonwell, Lido, Beefy, Qidao, Wormhole and a long list of projects to develop a robust trading venue for the ecosystem.

StellaSwap is made up of a tight knit group of technologists and DeFi natives that previously founded one of the first regulated digital assets exchanges in the Middle East. Our founding team also includes a senior research associate from London School of Economics (LSE). Our team brings a wealth of expertise in digital assets trading and security systems, with prior experiences across high growth start-ups. We have been fully KYC-ed by the Moonbeam team.

PERFORMANCE & ANALYSIS

Before proceeding to deeper details of our proposal, it is only fair that we provide an overview of our performance in the last 6 months.

Achievements

Here is the list of things that StellaSwap has embarked on and launch in order to strengthen Moonbeam’s position as the leading Polkadot hub;

- Proven Capital Efficiency for Ecosystem Liquidity via Launch of Pulsar

We launched Pulsar at the start of the year to significantly boost capital efficiency for the ecosystem with the most efficient AMM to date. The success of Pulsar is manifested in;

- Utilization rate between 20%-100% vs standard AMM’s 5%-10%

- Efficiency rates of 10X - 20X

- Low-slippage trading with much lower TVL requirements

- Sustainable yields via trade fee generation

- Launch of the first emissions-free farm (Astar)

- Simplifying User Journey via Key Launches

We launched several features that aimed to simplify users’ DeFi journey to maximize our grants, These include;

- Fostering Cross-Chain swaps with Squid + Axelar, creating strong traction that led to greater capital inflows to Moonbeam. The top 2 out of 3 most popular paths for crosschain swaps was initiated towards Moonbea, from BNB and Polygon.

- XCM Transfers for native inter-parachain asset transfers

- Alleviated native USDT acquisition limitation with Meson

- Gas refunds program to foster greater trading

- Developed universal router for auto-trade routing across all our AMMs

- Igniting Moonbeam as the Hub

- Worked with Moonwell to establish Moonbeam Ignite campaign to spread the word on Moonbeam

- Active participation in AMA’s with PolkaWorld, TeriyakiDon, DTMB, Polkawarriors to engage the community and attract users

- Worked with DTMB & Moonwell to establish Moonbeam’s DeFi Voyage NFT campaign to spur activity within the ecosystem

- Worked with parachains such as Acala, Phala, Astar to launch their native tokens on Moonbeam

CONNECTED CONTRACTS USE CASE (Updated Feedback from Turritz)

This is something we’ve been EXTREMELY EXCITED about! For context, we’ve been working with Squid since last quarter of 2022 to lay the infrastructure + provide optimizations for crosschain swaps (CCS). Kudos to the Squid team for their thought-leadership and responsiveness in ensuring CCS was perfect. The coordinated launch of CCS swaps on Moonbeam was a huge landmark for the ecosystem, and StellaSwap was the first to launch CCS powered by Squid & Axelar. The importance of CCS in abstracting complexities and simplifying DeFi was the main reason why we were extremely enthusiastic about CCS and pushed forward a slew of targeted marketing campaign (e.g. with Moonbeam, Polygon, Arbitrum) to drive adoption and capital inflow towards Moonbeam. We’re proud to say that CCS on Moonbeam has been a great success, with Moonbeam leading the charts on usage and capital inflows:

We will continue to induce behaviour towards using CCS, especially for first-time users and draw users toward Moonbeam, with the help of Squid+Axelar+participating ecosystems.

Beyond CCS as the base layer utility of connected contracts that just went live on Moonbeam on StellaSwap, we’re excited to also explore greater usecases that is built on Squid+Axelar’s infrastructure, such as one-click ZAP into LPs or borrowing protocols. With protocols like Prime going live very soon focused on cross-chain borrowing/lending, we’re excited to establish the liquidity infrastructure to power their use cases.

GRANTS PERFORMANCE

Let’s take a look at the performance of the previous grants cycle.

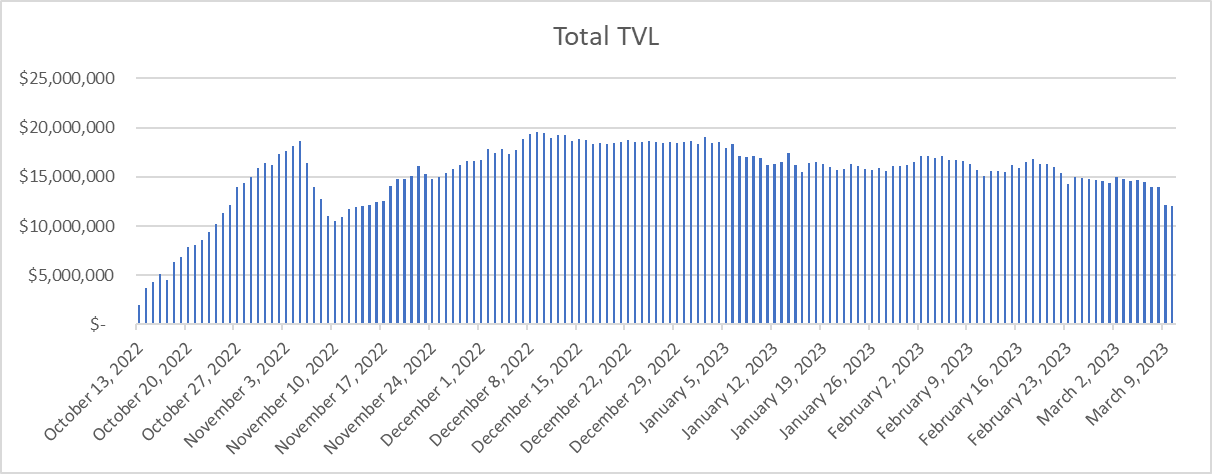

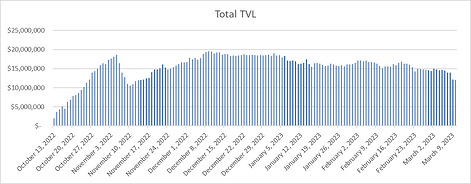

TVL Targets (Updated feedback from Natalia)

Our initial forecasted target for the first 4 weeks was $26M, which we promptly hit as we topped at around $28M. From then on, the market turned north as GLMR tanked approximately 40% in price from a high of $0.53 to a low of $0.32 in a span of two weeks. General market conditions were bleak, with the entire market bleeding along the same ranges. This impacted our TVL growth, as TVL is fuelled by 1) the USD price of GLMR & STELLA emissions as well as 2) USD price of all assets on our farm.

Market drawdown was aligned to the reduction of our TVL growth forecasts.

Total Volume

We’ve had a healthy cadence of trade volume throughout the duration of the grants, averaging around $1M - $2.5M daily.

User Count

We’ve also had a good range of daily unique users on Pulsar, averaging 500 daily.

RATIONALE

The Moonbeam ecosystem will stand to gain in the following ways;

-

Foster Market Depth

With the next round of ecosystem grants, StellaSwap can deepen ecosystem liquidity depth to foster greater network activity on Moonbeam. Greater market depth facilitates efficient price discovery, which is required for protocols such as Moonwell, Prime protocol, DAM - and a host of DeFi applications - to operate. With incentives, there will be an inflow of new users that will be exposed to the various use cases within the ecosystem, including connected contract capabilities. Developers are more inclined towards building their dApps on a network with critical mass. -

Optimize UI/UX for Simplicity

With greater effectiveness of ecosystem liquidity (TVL) on Moonbeam, price discovery for token value would be the most optimal and slippage would be mitigated, thereby resulting in a conducive trading environment for users. Ultimately, end users will reap the rewards from a liquid market on Moonbeam from ecosystem incentives, resulting in lower slippages and a more streamlined user experience. -

Extending Cross-Chain Connected Capabilities

As part of Moonbeam’s vision as the hub for connected smart contracts in DeFi, StellaSwap aims to extend cool cross-chain usecases that adds more network utility, engagement and composability. We’re proud to be one of the first projects to support such advancements, starting with the launch of cross-chain swaps in conjunction with Squid & Axelar. In just a span of a month, we’ve managed to hold the 2nd spot (Polygon > Moonbeam) and 3rd spot (BNB > Moonbeam) for the most popular cross-chain trade route.

WHAT IS PULSAR?

We’re extremely proud to announce the next evolution of StellaSwap: concentrated liquidity. We’ve partnered with Algebra to launch a capital-efficient DEX called Pulsar, which represents a ground-breaking enhancement to StellaSwap’s current hybrid DEX, utilizing the power of concentrated liquidity to provide a much more efficient way of trading and earning as before. With Pulsar, users will access optimal asset prices, low-slippage and greater yield optimization for LP stakers!

Here’s a quick summary of how concentrated liquidity is a beast of AMMs;

-

LPs can provide liquidity with up to 4,000x capital efficiency relative to standard AMMs, earning higher ROIs on their capital

-

Liquidity utilization rates beyond 100%, compared to an average of 5%-10% that StellaSwap currently has. This is good news for LPs as they’ll earn more fees for a given capital base

-

Capital efficiency results in ultra-low slippage trade execution that can surpass both centralized exchanges and stable AMMs

-

LPs can significantly increase their exposure to preferred assets and reduce their downside risk

-

LPs can sell one asset for another by adding liquidity to a price range entirely above or below the market price, approximating a fee-earning limit order that executes along a smooth curve️

-

With greater ROI potential, STELLA emissions can be exponentially reduced. With a reduced inflation rate, we’ll be on the path of tokenholder-value maximization

VISION OF SUCCESS

On a high level, our vision is to be the Schelling point for trading on Polkadot. With Polkadot’s Cross-Consensus Message Format (XCM) to unite inter-Polkadot liquidity and the rise of cross-chain connected contract applications to unlock inter-network synergies, our main goal is to harness total interoperability for Moonbeam network.

In order to further work towards our vision, the core of our foundation as a DEX is predicated on providing a robust trading infrastructure that fosters a conducive environment to enable the most optimum price discovery. Once this is established, we can observe the actualization of flyover effects as protocols tap on StellaSwap’s liquidity depth for their corresponding use cases.

As we’ve demonstrated the establishment of baseline market depth, the next chapter entails unlocking capital efficiency to ensure ecosystem grants go much further in deepening ecosystem liquidity. The transition of both protocol & ecosystem emissions towards Pulsar will further reduce the cost of trading and would set the stage for sustainable yield generation emanating from organic trade fees. This has been validated via the launch of Pulsar, which has seen tremendous capital efficiency gains in the last month.

Here’s the list of suitable metrics that will be fervently tracked for the upcoming new grants program;

1) Cost of Trading

The ultimate goal for the usage of ecosystem rewards is to create a conducive market environment that fosters efficient pricing is the cost of trading. This is generally divided into two main components;

-

Trading Fees: One of the core features of Pulsar is its dynamic (variable) fee component, that adjusts itself based on a myriad of factors that include asset volatility, liquidity and trading volume. Based on analytics, Pulsar’s trading fees have been consistently lower than the fixed 0.30% used by other AMMs.

-

Price Impact: The most important metric related to the cost of trading is price impact, which is similar to the notion of slippage on an AMM. Essentially, a more efficient AMM like Pulsar would enable much lower price impact for trades. Pulsar’s efficiency enables ecosystem grants to be more productive in creating a deeper market, which translates into lower price impact. Ensuring price impact is low for trades facilitates greater trading efficacy, which creates a positive loop for liquidity deployment.

Moving towards measuring the effectiveness of liquidity relative to its quantity (TVL) would allow us to measure how far a certain amount of grants has succeeded in creating a conducive trading environment. In order to illustrate this point, we can analyze the current variance of TVL & price impact of pools from different AMMs;

Pool 1: USDC - GLMR

- AMM: Standard AMM

- TVL: $2M

- Price Impact of $5k trade: 0.52%

Pool 2: USDT- DOT

- AMM: Pulsar

- TVL: $176k

- Price Impact of $5k trade: 0.49%

With a TVL of more than 12X, USDC-GLMR has a higher slippage when trading a value of $5k. Although this clearly highlights the power of Pulsar, the emphasis should be on tracking the desirable price impact degree that ecosystem grants will foster.

2) Trading Volume

Greater volume indicates greater user activity on the chain, and is perhaps one of the most important metrics to optimize for a DEX. We were successful in attracting volume to the ecosystem as StellaSwap became the first DEX in all of Polkadot to surpass $1B in cumulative trading volume. Even with a lower grant amount, we’re confident of attracting a higher pace of trading volume when Pulsar is live with ecosystem rewards. Our average volume of around $2M daily was within the targets of the previous grants program, which we hope to surpass with the utilization of the upcoming grants.

3) Total Value Locked (TVL)

It is inevitable that TVL is regarded as one of the strongest indicators of popularity and health of any ecosystem. The higher the TVL, the stronger the ecosystem as it is more trusted and reliable. As we’ve hit the TVL targets that were previously forecasted, TVL will continue to be an important - but not defining - metric of evaluation. This is because TVL is quoted in USD, and is affected by numerous macro factors that may affect TVL targets which are beyond our control. Systemic shocks, volatility of bluechips and network effects can all affect our TVL targets.

The TVL forecast is highlighted in the Use of Grants section.

4) Unique Users

User acquisition is a core metric for growth of any protocol; a growing protocol is attributed - in part - to an increase in the number of users. It is imperative to track and optimize for user acquisition, especially when ecosystem incentives are used. The objective is to attract and onboard as many users as we can onto the Moonbeam network.

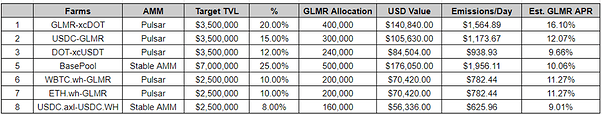

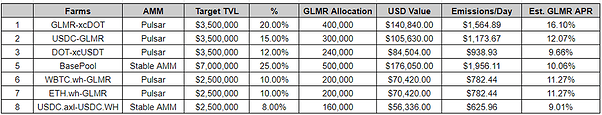

USE OF GRANTS TIMELINE

It must be emphasized that the totality of the 2M grants will be used to incentivize farms on both Pulsar & stable AMM to deepen liquidity. Under no circumstances would any of the grants be used for development or any other purposes beyond incentivizing the farms, which goes to LP stakers.

This current round of grants will run for approximately 3 months, and will be used to incentivize strategic farms as part of the transition to Pulsar. Strategic farms are made up of assets of strategic importance, which are in the form of blue-chips. Pulsar will ensure that grants will go a longer way in attracting more sticky and sustainable liquidity. Although the TVL forecast of this current grants round would be similar to our previous grant application, the market depth from Pulsar’s TVL will be multiplied given the greater concentration of liquidity. This will allow protocols within the network to tap on our deep liquidity for their full-functioning.

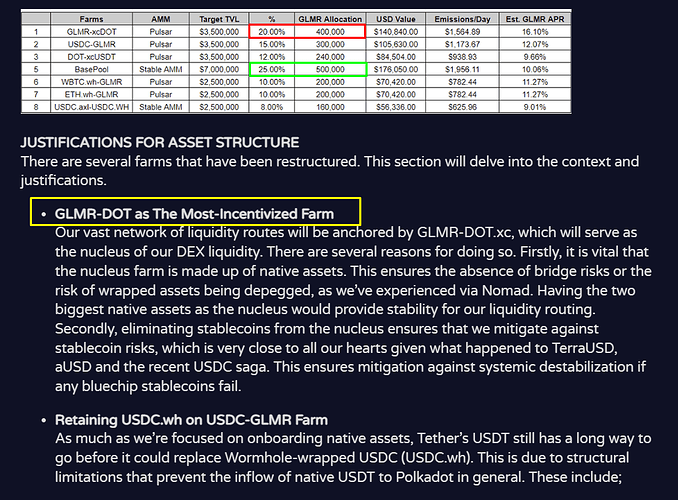

JUSTIFICATIONS FOR ASSET STRUCTURE

There are several farms that have been restructured. This section will delve into the context and justifications.

-

GLMR-DOT as The Most-Incentivized Farm

Our vast network of liquidity routes will be anchored by GLMR-DOT.xc, which will serve as the nucleus of our DEX liquidity. There are several reasons for doing so. Firstly, it is vital that the nucleus farm is made up of native assets. This ensures the absence of bridge risks or the risk of wrapped assets being depegged, as we’ve experienced via Nomad. Having the two biggest native assets as the nucleus would provide stability for our liquidity routing. Secondly, eliminating stablecoins from the nucleus ensures that we mitigate against stablecoin risks, which is very close to all our hearts given what happened to TerraUSD, aUSD and the recent USDC saga. This ensures mitigation against systemic destabilization if any bluechip stablecoins fail. -

Retaining USDC.wh on USDC-GLMR Farm

As much as we’re focused on onboarding native assets, Tether’s USDT still has a long way to go before it could replace Wormhole-wrapped USDC (USDC.wh). This is due to structural limitations that prevent the inflow of native USDT to Polkadot in general. These include;

- Difficult Onboarding for Bitfinex: Right now, the only way to mint native USDT is via Bitfinex, which - due to their KYC parameters - prevent a good chunk of users from native transfer and minting of USDT.

- Limited Payment Rails: CEX withdrawals of DOT directly to statemint or Moonbeam is still extremely limited, which impairs the ability to transfer over their USDT from other L1s/L2s. We’ve done our utmost in relaying our feedback to Parity on this and even took the initiative to integrate with Meson, the stablecoin bridging protocol that leverages atomic (HTLC) swaps.

Due to this, the supply of native USDT is limited and fostering USDT as one of the highly-incentivized farm will be more expensive to maintain, given the premium required to support USDT over USDC.wh, owing to limited supply. There’s currently 3x more supply of USDC.wh vs native USDT.

-

Converting USDC.axl Metapool to USDC.axl-USDC.wh Farm & Its Importance

USDC.axl represents one of our strategic farms as it represents the conduit for crosschain swaps.This has been an extremely popular feature for users to streamline their DeFi journey and reduce friction. Having a deep USDC.axl farm allows greater crosschain swap utility. As to why there’s a restructuring of USDC.axl from a metapool to a direct USDC.wh farm, we believe that a correlated USDC farm would be more effective in attracting the desired liquidity and mitigate against stablecoin risks, which is at the maximum in a basepool configuration (a single depeg can mess with basepool’s dynamic). During the recent SVB failure that led to an uneasy weekend for USDC, there was considerable capital outflow from the basepool. The same underlying USDC - though different permutations - is more safer as compared to a basepool setting. -

Exclusion of Lido’s stDOT Farm

Lido has announced that they’ll sunset their stDOT facility and recently they stopped providing LDO reward on Curve. In a couple of months, stDOT will cease to exist. Therefore, it is prudent to stop emissions for Lido’s stDOT.

TVL MILESTONES & CONDITIONAL REQUIREMENTS

(Updated feedback by Natalia)

The primary TVL milestone that the success of the grants program would be the aggregate TVL of all farms on StellaSwap, measured by the quantity of assets and not dollar value of the assets. One major limitation of tracking TVL based on the dollar value is that it is highly dependant on the volatility of asset prices. The main methodology of analyzing capital inflows is the quantity of assets that is flowing into Moonbeam, which does not take into consideration the fluctuating value of the asset. That being said, it is difficult to track asset quantity and TVL is the most appropriate aggregate metric for now.

Based on that, our target TVL would be around $20-25M - throughout the duration of the established grant duration. The failure for StellaSwap to reach a base TVL of $25M would require us to increase STELLA emissions in order to reach the $25M base. This is a sign of our commitment in ensuring that there is sufficient base liquidity to power the ecosystem.

In the opposite scenario where market conditions tend to be positive and GLMR prices pick back up, we will maintain status quo and facilitate the reflection of the increased APRs that will seek to deepen ecosystem liquidity. This will be highly beneficial to the ecosystem where the flywheel effects could be enhanced, given the limitations of a relatively small ecosystem grant cap (Level 3).

The reality is that if we don’t put sufficient incentives on Moonbeam ecosystem projects, we won’t attract meaningful liquidity and will continue to be a “ghost chain”. StellaSwap is deeply invested in the ecosystem, and is building for the long term, but there are certain economic realities that liquidity providers have when it comes to providing liquidity in an ecosystem:

- If the rewards are not sufficient in the form of APRs that justify the risk, LPs will not take the risk of using a new ecosystem, especially if bridges are involved.

- If LPs choose to bring their liquidity to other ecosystems with higher reward APRs, there may never be enough liquidity for Moonwell to establish healthy collateral ratios for these markets because liquidations cannot be successful.

Secondary Metrics Tracking*(Updated feedback from Natalia)

It is important for StellaSwap to also ensure the tracking of secondary metrics in a transparent manner so that we can analyze the effectiveness of the grants program. Here is the following secondary metrics that will be tracked, which is similar to prior metrics that were furnished to the Foundation during pre-Nomad times;

- Avg Trading Volume (Daily)

- Avg No. of Txns (Daily)

- No. of Unique Users

- Trade Fee APRs

- Farms APR

STEPS TO IMPLEMENT

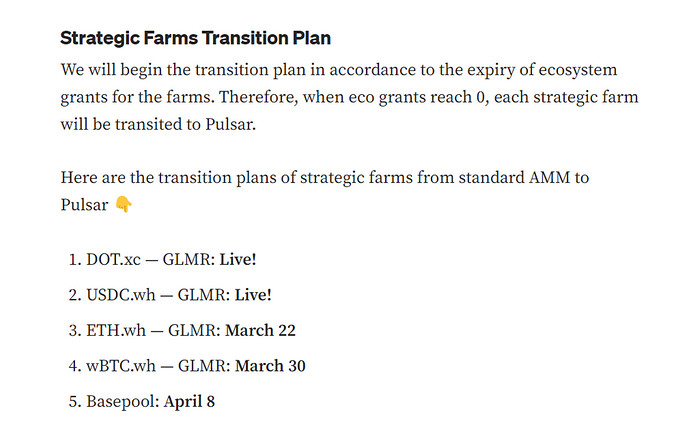

We’ve launched Pulsar mainnet at the start of the year in order to prove the power of concentrated liquidity. After close to 2 months, we’ve optimized Pulsar and is ready to ramp up the next phase of liquidity building. In terms of the sequential steps;

- We’ll begin transiting strategic farms from Standard AMM to Pulsar on the last week of March in preparation for the grants

- Newly-transited Pulsar farms will be powered with STELLA token first

- Once grants are received, we’ll push the grants directly to the established farms on this proposal

Strategy for Farm Launches (Updated feedback from Natalia)

We’ve announced the formal plan for farm transmission, which entails;

SECURITY (Updated feedback from Turrizt)

Security is a core aspect of StellaSwap that deserves a section on so that the community can appreciate the processes that we’ve established. Here is a list of security mechanisms on StellaSwap;

- All our AMMs have gone through full audits via Certik & Solidproof

- Pulsar has been audited by ABDK consulting & Hexen. We partnered with Quickswap to do an additional layer of audit on Code4rena before deployment

- We have one of the highest bounty in the ecosystem on ImmuneFi across Critical & High

- Users can also insure their positions on LP of up to $1.5MM in capacity on InsureAce, covering SC vulnerability.