Hello ser,

Thank you for your support and we appreciate your feedback!

We hear you, and we propose another line of thinking. For any ecosystem to succeed, there must be sufficient market liquidity. The absence of a deep market to foster efficient markets will drive away projects, usecases and users. As the leading DEX, we want to continue to contribute to that singular cause. We believe that grants allocation should be bifurcated on 1) primitives deepening liquidity and 2) projects fostering flyover effects. The former category is focused on fostering market depth, which is essential in any ecosystem, while the latter is focused on generating usecases, utilities for ecosystem growth (which its success is also dependent on ecosystem liquidity depth established by the former).

It is clear that StellaSwap and any other DEX belongs to the former category. Then comes the next question; equal/near-equal distribution to all DEXes? We agree, that sounds fair, but is plausible in a perfect world where there’s no limitations on grants and we have a good depth of liquidity to begin with. But we don’t, and the existence of these limitations require a hard trade-off. This is a hard problem and we implore alternative suggestions by the community. In parallel, StellaSwap will continue to innovate to ensure that we have a robust trading infrastructure that will make every dollar of TVL count towards creating a conducive trading environment for efficient price discovery. To that very end is our motivation for the grants.

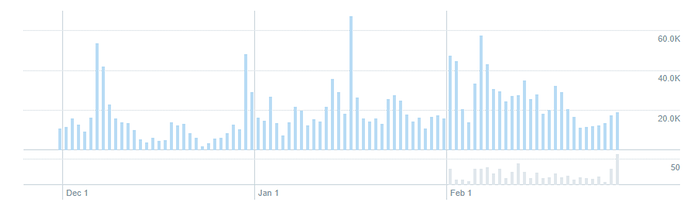

Context for Life Before Grants

Before getting any grants, we were the top DEX both in terms of TVL & volume. I hear your point about the dependency on grants, but the bigger picture is ensuring sufficient market depth to enable ecosystem growth. To be clear, StellaSwap is and should be arbitrary, in that the most important thing for the ecosystem is a robust trading environment that can only happen with sufficient liquidity. If you agree on this, then the natural question should be “How?”

StellaSwap has proven to be one of the top builders in the space, with several launches aimed to simplify DeFi and onboard new users. Pulsar, cross-chain swaps & universal router was shipped in the last 3 months. In order to transition liquidity from V2 to Pulsar, which is far more superior in terms of capital deployment efficiency and facilitating low-slippage trading, we need to have a fresh round of grants. That is why we’re highly supportive of the newly revised grants that has a cap of 2M for each tranche to ensure fairness.