Hi Everyone,

I wanted to open a discussion about Moonbeam inflation and how can we naturally decrease it but still maintaining the network stability

Today, the inflation is 5% compounding, meaning the number of minted tokens increasing year by year. When total supply was 1B tokens, those 5% inflation was 50m GLMR per year, while today those 5% are almost 60m GLMR.

Moonbeam partnered with Gauntlet to suggest a new optimized tokenmic model, and as part of their job, they suggested a new allocation within the 5% inflation. However, they haven’t recommended changing the inflation itself (size nor model).

I suggest changing the inflation model from compounding to linear. It means fixed annual expansion of total supply

The advantage of the linear model is that the inflation naturally & gradually decreases over the years thanks to the convexity. It keeps the network healthy and sustainable, rather then deciding in arbitrary way to cut the inflation by half for example

The main question is what should be the fixed amount? To avoid sharp moves, we should start with [5% x totalSupply]. The current total supply is 1.17B tokens, but if we take the time we need for discussions and implementations, we can initiate it when the total supply hits 1.2B tokens. In that case the annual minted amount should be 60m tokens

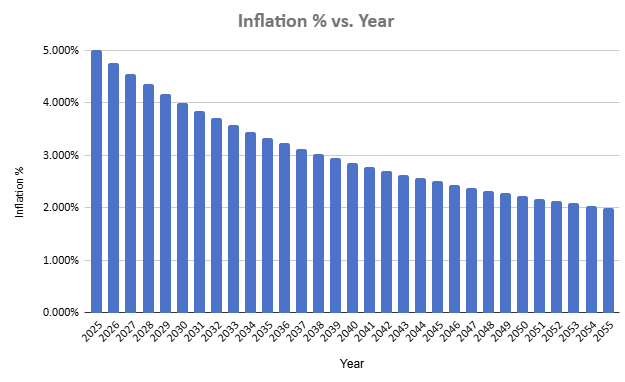

To illustrate how minting 60m tokens in a course of 30 years impact the yearly inflation, please have a look at the chart below:

Assuming we start with 5% inflation in 2025 - it drops to 4% & 3.33% after 5 & 10 years, respectively. The convex curve ensures the inflation decreases less each year and this way minimizes the reduction impact

We’re not inventing the wheel here - any ecosystem tries to find the balance of minimizing the inflation subject to keeping the network secured and sustainable. The linear approach makes it possible since it lets the market digest the changes in reasonable time and simultaneously reduce the selling pressure.

The main claim against it will be the decreasing delegators and collators rewards and therefore may cause people to leave the ecosystem. This is fair argument but let’s break it down:

-

Delegators - currently the staking APR is around ~10% (assuming we remove outliers). Let’s assume total stake share remains the same - it means that 5 years from now the APR will decrease to 8%. This is not a meaningful impact at all. Needless to say that modest price appreciation of 20% in those 5 years will totally offset this loss. The same logic works for a longer period but we all know that 5 years in crypto is like 50 in real life:)

-

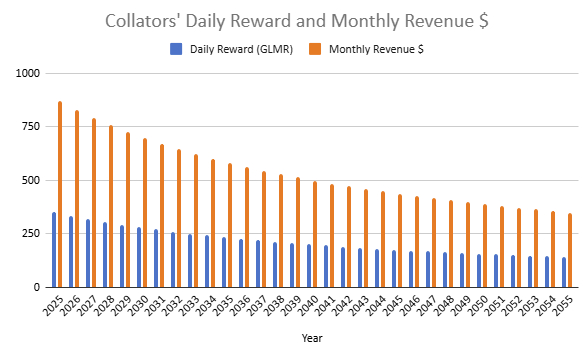

Collators - Same as delegators, running moonbeam collator will still be profitable even if the reward is decreasing by 20% in 5 years. Unlike 99% of the networks where the top 1% validators take 99% of the rewards, in DOTSAMA ecosystem rewards are evenly distributed between collators/validators (regardless their pool size and assuming similar performance/fee). Therefore, such inflation changes are much easier to mitigate and digest

Last but not least - I won’t go around here - one of the purposes of this move is increasing the price by reducing selling pressure. Simple as that. No need to be an economist to realize that less minted tokens → less selling pressure. I also wouldn’t ignore the psychological impact when people hear about this move, where the inflation is naturally decreasing year by year. I’m sure it’ll have a positive impact (and not only for a short term). In addition, this move together with other burning mechanism we should discuss and consider could really make Moonbeam deflationary one day, and this will be a game changer for the token demand

If that happens - I have no doubt that no one would really care if he/she gets 20% less tokens while the GLMR price strongly compensates for it. The way I see it, the lower the inflation, the higher the chances GLMR rewards will be worth much more in $ value . Therefore it should be everyone interest to lower it

Will be happy to hear your thoughts!

Rafael

** Disclaimer - I’m a collator in both Moonbeam and Moonriver networks