Executive Summary

In line with our commitment to transparency and decentralization, the Moonbeam Treasury Program has now been active for the past two years. This report provides an essential overview of the program’s accomplishments and progress during the past six month’s Treasury Council’s 4th term, July - December of 2024.

The Moonbeam Treasury Program was officially initiated following the community approval on 19th of October 2022, marking a pivotal step towards fostering a transparent and decentralized ecosystem. In December 2023 the Moonbeam and Moonriver community voted to renew the Treasury Council for another term and allow new members to apply for the community seats in the program. The voting successfully concluded and the following community members were elected for the 4th term in 2024 of the Treasury Council:

- Simon K. (extended term)

- Michele A. (extended term)

- Yaron Z. (extended term)

As Foundation members the following individuals were reappointed by the Foundation:

- Aaron E. (extended term)

- Lina K. (extended term)

Further reading on the Treasury on Moonbeam in the Docs’ Treasury section.

Overview

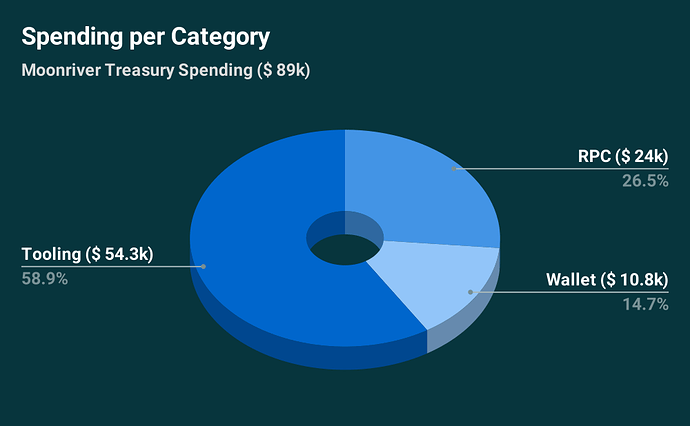

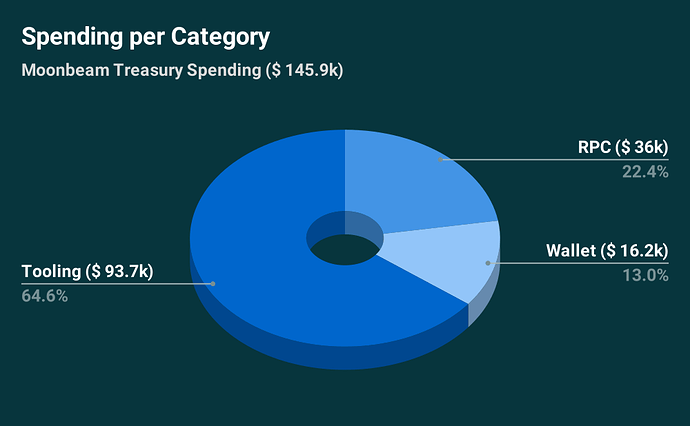

The funded proposals on both the Moonbeam and Moonriver Treasury can be categorized into three major categories:

- Wallet development — Moonbeam Safe Multisig Support

- RPC — High quality RPC infrastructure services for Moonbeam, Moonriver and Moonbase Alpha, incl. bootnodes provisioning.

- Tooling — Karma Delegate Dashboard; stakeglmr.com / stakemovr.com; Subscan.

A public, nicely formatted list containing all proposals alongside relevant info is kept updated by the Council at the time of proposal submission in the MB Foundation’s Treasury repository.

Moonriver Treasury

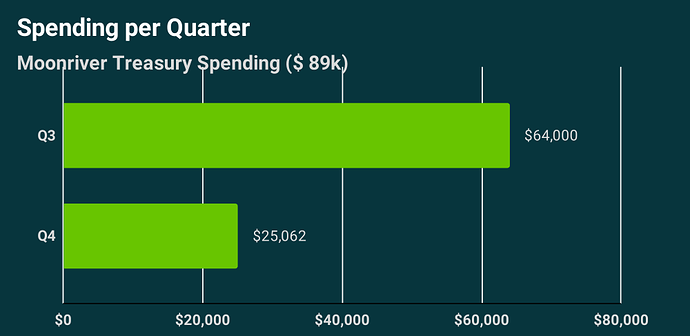

The Moonriver Treasury had a total spending of $ 89k during the second half of 2024.

USD values reflect the 30-day moving average price value derived from the value and respective amount of MOVR tokens during the agreement with the proposing party – very close prior to proposal submission on-chain in most cases.

Spending per Quarter

Spending per Category

Moonbeam Treasury

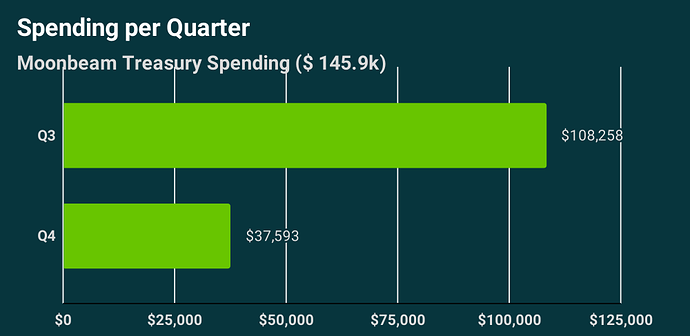

The Moonbeam Treasury spent a total of $145.9k in the second half of 2024.

Spending per Quarter

Spending per category

The distribution in spending highlights the diversity of proposals funded, besides the historically major expense of RPC infrastructure.

Interestingly, looking closer at the cost breakdown, the spending percentages of the Moonbeam Treasury across categories are closely related to those of the Moonriver Treasury.

However, unlike the breakdown in previous terms, the Moonbeam Treasury burdened a much greater total amount than the 60:40 GLMR to MOVR split ratio and Treasury burden targets… This is largely related to the Subscan proposals which took different expense factors and payouts into account which the Council agreed to.

Resource Allocation

The Moonbeam Treasury Program is committed to maintaining equitable resource allocation for the sustainability of our treasuries. The Treasury Council always considers the Moonriver and Moonbeam treasuries as a combined pool for the proposals that serve or benefit both networks.

This prudent allocation ensures the long-term viability of both treasuries and provides fair support to the projects within the Moonbeam ecosystem. In specific instances where applicants exclusively provided benefits or infrastructure to a single network, proposals fully denominated in either GLMR or MOVR were also considered and approved by the Treasury Council.

Following last terms update of payout on a 60:40 GLMR to MOVR split ratio, the Council maintained that ratio throughout the term as last terms positive price action of the MOVR token has presented itself to be rather sticky and in synchrony with the GLMR token for the most part.

The Treasury Council is committed to periodically review and update that payout ratio.

Expense Breakdown

Our current resource allocation strategy places a focus on supporting the vital role of RPC providers in advancing the development and performance of the Moonbeam ecosystem. These providers are instrumental in ensuring the seamless operation of our network and are the cornerstone of our success.

Additionally, a portion of the allocated funds is earmarked for initiatives that serve the common good. This allocation reaffirms our unwavering commitment to projects that are community-driven and benefit the broader ecosystem.

The Treasury Council has laid out a semi-annual budget of 625,000 GLMR and 6,250 MOVR from the respective treasuries to sustain our ongoing efforts. Furthermore, we supplement this budget with monthly contributions from the Orbiter program, enhancing our capacity to support key initiatives. Moreover, the unutilized budget from the previous quarter is rolled over to the following period.

The Moonbeam and Moonriver Treasuries were each pre-funded at launch with 0.5% of the token supplies and have since been accumulating GLMR and MOVR from an approximate 20% portion of transaction fees, respectively.

From the genesis balance of 5m GLMR and 50k MOVR, the respective treasuries currently hold balances of 5.3m GLMR and 77.3k MOVR. These figures represent an overall growth of 300k GLMR and 27.3k MOVR which demonstrates the Treasury Council’s commitment to long-term sustainability.

Treasury Balance 6-months development in numbers:

| Moonbeam | Moonriver | |

|---|---|---|

| 2024/06/30 | 5.2m GLMR | 72.7k MOVR |

| 2024/12/16 | 5.3m GLMR | 77.3k MOVR |

The treasuries respective balance can viewed and verified on-chain:

- Treasury Council address on Moonriver: 0x6d6f646c70792f74727372790000000000000000

- Treasury Council address on Moonbeam: 0x6d6f646c70792f74727372790000000000000000

Despite the very significant retroactive payout for services delivered in 2022 and 2023 which marks a heavy outlier to the upper bound in the average spending corridor of the Treasury’s previous spending, overall Treasury balances have not decreased during the past 6-months term but have in fact increased which we consider an overall success in sustainable Treasury management.

To sum up, the Treasury Council’s commitment to the long-term success of the program is evident through our conscientious budget management. We had consistently kept our expenditure well below budget in previous terms while still funding key contributors to the ecosystem.

Due to the large-scale retrocactive funding of a major proposal we have spent more than budgeted initially (7,855.76 MOVR spent vs. 6,250 MOVR budgeted and 751,695.61 GLMR spent vs. 625,000 GLMR budgeted). This increase in payout however did not harm the Treasury’s balance sheet as we have been able to accumulate MOVR and GLMR on a six moths basis regardless. This reflects our dedication to the sustainability and growth of the Moonbeam ecosystem.

Operational Expansions

As part of our ongoing commitment to strong ecosystem governance and community engagement, the Treasury Council executed multisig operations to address ecosystem initiatives during the second half of 2024. These strategic operations underscore our ability to flexibly manage and execute on emerging opportunities.

Governance Initiatives

Foundation side Treasury Council member and governance researcher Lina K. initiated the first Moonbeam Governance space on X / Twitter which included an airdrop to reward active governance participants and was later facilitated by the Treasury Council via the CSV Airdrop app for the Moonbeam SAFE multisig deployment.

Community Engagement Airdrop

- Objective: Enhance community involvement and recognition

- Deployed a SAFE multisig on Moonriver and facilitated a community-centric airdrop of MOVR tokens

- Facilitated an airdrop of GLMR and PINK tokens via our existing SAFE multisig on Moonbeam

The successful implementation of such initiative demonstrates the Treasury Council’s operational agility and commitment to community engagement.

It stands in line with the successfully conducted PINK airdrop in the previous term and confirms the reliability of assigning such tasks the Treasury Council’s community members.

The Moonbeam Foundation exclusively founded the two SAFE’s for the airdrop upfront.

- Treasury Council SAFE multisig on Moonriver: 0x577BC3501a0Fba9B9564755dD01dc6677B5Eb31d

- Treasury Council SAFE multisig on Moonbeam: 0x8A9319bb46Be3bFbE96c92Aad77905218C293134

Both multisig accounts were established using a two out of three confirmation setup using the accounts of Sik, Michele and Yaron as its owners.

Funding RPC Providers

Our previously updated award policy for RPC providers had previously proven successful and was therefore kept as is. This policy limited the RPC provider expense to 35% of the budget for each designated period with the aim to give smaller, agile operators a chance to join at competitive price tags and to force larger RPC providers with proven track records to propose funding at more competive price tags

In response to our call for RPC proposals, five teams stepped forward with their proposals:

The Treasury Council then initiated a rigorous evaluation to determine which teams were best suited to receive funding. Following the evaluation process, the Treasury Council collectively selected UnitedBlock, RadiumBlock and Dwellir as the three RPC providers for Q4 2024 & Q1 2025.

The fact that we were able to select and fund a total of three RPC providers underscores the strength of the Treasury and the Council’s ability to negotiate and create a competitve environment among RPC service providers with market forces in play to make the best and most efficient providers emerging successful.

We’ve been monitoring performances using comparenodes.com and evaluating proposals for factors such as continental decentralization, latency, availability, redundancy, eth_getLogs method inclusion, overall track record and effective price point.

To learn more about the selection criteria read here.

The existing funding model for RPC providers which was previously shifted to an upfront model with an agreed-upon payout that significantly reduces costs compared to the previous arrangement and leads to better spending plannability for the Treasury Council was kept.

We believe that our RPC funding management once again successfully achieved its objectives by reducing expenses, involving the community in the decision-making process via the forum and enabling the Treasury Council to select providers that best align with the networks’ long-term stability, decentralization and the Treasury’s sustainability.

Conclusions

We have seen a significant increase in total spending compared to H1 of 2024. Looking into the data however, this is mainly due to an outlier accounting for a major spend. This outlier is the retroactive funding of Subscan for 2022 and 2023. This spend accumulates four quarters in total and with Subscan bringing significant fundamental value to the ecosystem a major expense for the Treasury and a project of high importance to the Treasury Council’s commitments.

The accumulated spending and data visualisations on both networks are skewed towards the multi-quarter retroactive funding of Subscan for 2022 and 2023 in Q4 of 2024 which amounted to $ 69k on Moonbeam and $ 34.5k on Moonriver marking an unexpected timing for a major expense.

The Moonbeam Treasury Council remains steadfast in its dedication to the core principles of transparency and efficiency that underpin the Moonbeam Treasury Program. We value the input and feedback from our community as it significantly influences the future trajectory of the program.

Comparing the RPC funding expenses with the Treasury Council’s previous term Transparency Report 2024 H1 the overall expenses visualized involve a significant outlier in the expense data – Subscan, the Moonbeam explorer requested funding retroactively for 2022 and 2023. While the costs themselves were reasonable, this request came extremly belated. However as the treasury stands very robust due to overall efficiency, we internally agreed to retroactivly fund their valuable services to our ecosystem and confirm the Treasury Proposals. We did remark the heavy buildup of quarterly funding requests as an issue with the team to ensure proper treasury planning and smoother cost distributions to the treasury in the future. This skews the H2 overall expenses downwards while adjusted for this singular event the treasury stands once again strong and in line with the previous terms’ Treasury developments.

To join the conversation please share your suggestions, demand clarifications or just leave a comment down below.

Please do not hesitate to reach out to the Treasury Council members @dev0_sik @Michele_Amurri @lina.k.m @aaron.mbf & @_yrn individually or simply mention all current Treasury Council members at once with @TreasuryCouncil and participate in any Treasury-related discussions in the forum! ![]()