Authors: Thibault, Tyrone

Abstract

- Bifrost is a dedicated liquid staking app chain leveraging off the Polkadot SDK and serving the omni-chain ecosystem.

- Bifrost is currently one of the largest Polkadot rollups in terms of Total Value Locked (TVL) with over $70M. It also has the largest TVL for liquid staked DOT (vDOT) with over 8M DOT ($60M). Bifrost has liquid staking solutions for other networks such as Astar (vASTR), Ethereum (vETH), Manta (vMANTA), Moonbeam (vGLMR), and Kusama (vGLMR).

- Bifrost launched the first and only GLMR LST with vGLMR in November 2022 and currently has a TVL of over 1.2M GLMR ($350k) with over 640 holders and is supported on both Substrate and EVM via omni.ls through SLPx.

- Similarly to what we have achieved on three consecutive occasions with the Kusama Treasury and the Polkadot Treasury, Bifrost would like to request a total of 5,000,000 GLMR loan partially in 2 phases over the course of 24 months from the Moonbeam treasury which would be used to reignite vGLMR, its liquidity and grow its use-cases within Moonbeam’s native DeFi ecosystem and its future utility within Moonbeams restaking plans. The loan structure is identical to our successful loans with both Polkadot and Kusama treasuries, whereby the total GLMR amount is returned in its entirety and with the staking rewards it has accrued during the loan term of 24 months to the treasury.

Liquidity loan proposal summary

Key highlights

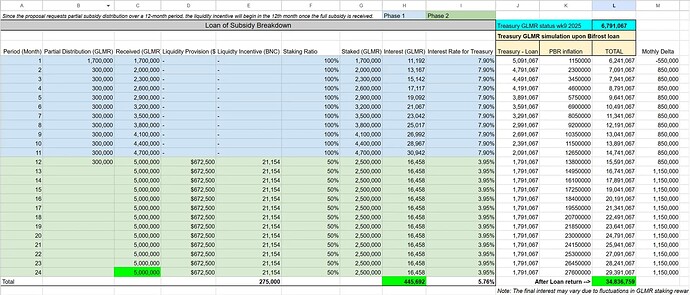

- This liquidity loan proposal would request the Moonbeam treasury to loan a total of 5,000,000 GLMR (approximately $800k as of writing) over the course of a 24 months period in 2 phases which would be repaid in full with roughly 5.76% annualized interest (roughly 445,692 GLMR in staking rewards) at maturity back to the treasury. (Check the breakdown here.)

- Phase 1: During the first 11 months of the loan, Bifrost receives the loan in tranches from the Moonbeam Treasury, with the full subsidy arriving in at month 12. All received GLMR during this initial phase will be used to liquid stake into vGLMR.

- Phase 2: From months 12 through 24, the 5,000,000 GLMR subsidy will then be evenly split between GLMR and vGLMR, providing liquidity on both Stellaswap and Bifrost Stable Swap.

- The structure of the agreement in its two phases is crucial as it allows to gradually build up vGLMR TVL without taking a significant initial amount of the treasury’s GLMR. This is crucial in then building deeper liquidity for vGLMR-GLMR on key native liquidity venues such as Stellaswap to ensure vGLMR growth and its broader use-cases across various DeFi applications and scenarios within Moonbeam’s ecosystem. Furthermore, building vGLMR native liquidity is fundamental in Moonbeam’s broader strategic expansion plans around Ethereum and the Actively Validated Services (AVS) in the restaking space in ensuring vGLMR potential collateral usage within those future usecases.

- Furthermore, the minting of vGLMR for the Moonbeam treasury is a compelling diversification strategy which puts its GLMR capital to work for a 24 months duration whereby it receives its GLMR principal back with staking rewards on its loan.

Motivation

Given Moonbeam’s strategic direction and expansion plans, Bifrost’s objective is to ensure that vGLMR becomes a key asset within those initiatives specific to DeFi and restaking and more broadly within Moonbeam’s native ecosystem and beyond. Bifrost aims to work closely with the Moonbeam community, its builders and its foundation to ensure that vGLMR can become a key strategic asset as part of Moonbeam’s plans in the restaking ecosystem. With Bifrost liquid staking expertise, track record and our development plans for 2025 we believe that there are many synergies to explore with Moonbeam and specifically vGLMR given that Bifrost will deploy SLPx on L2s and Ethereum in Q2 of 2025 and our relationship with Symbiotic and the broader restaking space. .

Bifrost strong treasury loan track record:

Bifrost has previously successfully repaid both its 2022 and 2023 - 50,000 KSM (over $2.5M) Treasury liquidity loan with interest to the Kusama Treasury for its liquid staked GLMR (vGLMR). More details can be found here regarding the 2022 and 2023 loans. In addition, Bifrost has recently in December 2024 successfully extended a 50,000 KSM treasury liquidity loan for 18 months with the Kusama treasury (more info here). Overall, with these previous initiatives Bifrost has brought a total income of 8,370.5523 KSM (over $300,000) to the Kusama Treasury. Similarly in early 2024, we successfully received a 500,000 DOT (over $4M) liquidity loan from the Polkadot treasury which will be repaid in March 2025.

Learn more about Bifrost treack record at here.

More about Bifrost

Bifrost is a Liquid Staking app-chain tailored for all blockchains. By leveraging off the Polkadot SDK and utilising decentralized cross-chain interoperability it empowers users to earn staking rewards and DeFi yields with flexibility, liquidity, and high security across multiple chains.

Learn more about Bifrost’s key advantages and features for vGLMR at here.

Developments and ecosystem collaborations

vGLMR TVL Recap

Bifrost launched the first and only GLMR LST with vGLMR in November of 2022. Since vGLMR’s inception it has seen a peak TVL of over 5.8M GLMR in March of this year and at present currently has a TVL of over 1.2M GLMR with over 640 holders. For more information regarding Bifrost analytics, please visit our Dune dashboard here.

vGLMR live with SLPx across different L2s and soon ETH

By integrating Hyperbridge, vGLMR can now be bridged to Base, OP, Arbitrum, and BNB Chain (visit Bifrost Dapp to experience it).

In the next phase, Bifrost will deploy SLPx across different chains. By leveraging Hyperbridge’s message crossing capabilities, users will be able to engage in GLMR liquid staking directly on Ethereum Mainnet, Base, OP, Arbitrum, and BNB Chain and use vGLMR in major protocols across these chains. This development is synergistic with broader Moonbeam strategic plans towards Ethereum hence leveraging off a yield bearing GLMR token like vGLMR is very compelling for both users and usecases.

vGLMR & DEX Liquidity

At present the vast majority of vGLMR liquidity is on Bifrosts’ Stable Swap in the GLMR - vGLMR Stable Pool earning roughly 10% APR. We also have an xcvGLMR-WGLMR pool on Beamswap which we have incentivised with both our native asset ($BNC), Beamswaps and GLMR on various occasions however this has failed to pick up due to a lack of further native use cases for vGLMR on Moonbeam. vGLMR could not be listed in 2023 on Moonbeam’s largest liquidity venue, StellaSwap for reasons which are still not clear to us. However, we have finally recently whitelisted xcvGLMR on Stellswap and will be looking to use it as the main native venue for vGLMR going forward - as Stellaswap is the clear leading native liquidity hub for Moonbeam. Furthermore, and for this new pool on StellaSwap Bifrost will be incentivising the xcvGLMR-GLMR pool with its native token $BNC to ensure there are compelling sustainable yields to drive the pools growth as we look to drive and expand use cases for vGLMR. Regarding the liquidity provision details, please check the following section.

Liquidity Provision

- As part of phase 2 of the loan structure, provide a total of 5,000,000 GLMR as GLMR/vGLMR liquidity in Stellaswap and Bifrost stable swap, check more details in the chart here in the section “Liquidity Breakdown”.

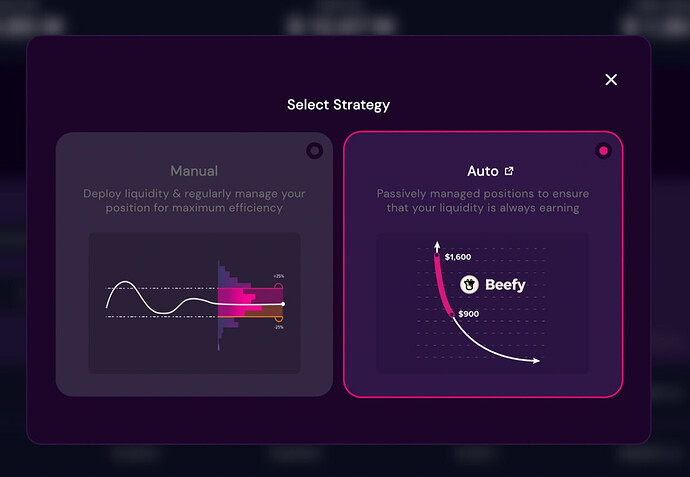

- The liquidity provision on Stellaswap will be allocated to the Automatic Pool, which is backed by Beefy Vault. The liquidity remains on Stellaswap, while Beefy Vault automatically manages positions across the most effective spots in a V3 pool.

- The Beefy Automatic Pool will launch on StellaSwap app soon, Bifrost will provide the subsidy via the app once live.

- The Automatic pool is not live yet on Stellaswap Frontend, as it needs Beefy to set up the Vault contract first.

- Timeline depends on Beefy’s load and their turnaround, as they prioritize vaults with higher TVLs across DeFi.

$BNC Incentives

Check the liquidity and incentive details in this chart. Below are the key points summarized:

- Target TVL of $2,500,000 on Stellaswap and $100,000 TVL on Bifrost Stable Swap.

- Allocate 90% of liquidity to Stellaswap to build deep native vGLMR on Moonbeam and to later enable vGLMR markets on Moonwell, Moonbeam’s largest lending and borrowing protocol.

- Provide 275,000 BNC as incentives for GLMR/vGLMR liquidity in Stellaswap:

- Establish initial liquidity of $1,125,000 through 2,250,000 GLMR and matching vGLMR value.

- Aim for $2,500,000 TVL with 5% target APR to secure 5,000,000 GLMR and equivalent vGLMR value.

- Allocate remaining 10% liquidity to Bifrost without incentives, as 500,000 GLMR protocol-owned liquidity sufficiently supports Bifrost stable swap.

vGLMR : Collateral (lending, restaking)

In reality much of Moonbeam’s existing DeFi scene is currently limited, thus focusing and building on one native vGLMR pool with deep liquidity on Moonbeam’s largest liquidity venue, Stellaswap, is key to enabling future use-cases for vGLMR. A priority for Bifrost, and a much requested use-case from holders and the community, is enabling vGLMR as a collateral asset on Moonbeam’s largest lending and borrowing protocol, Moonwell, as well as on Prime protocol. However, this requires a minimum amount of native liquidity and depth to enable a vGLMR market on both protocols. As part of this initiative, Bifrost has already worked on a mint/redeem exchange rate price contract on Moonbeam to enable these lending/borrowing market use cases- please check section “XCM Oracle”. Adding vGLMR will tap into the existing borrowing demand for GLMR however provide the value offering of using a yield-bearing collateral and enable looping opportunities for GLMR - vGLMR, providing a strong yield source for GLMR and enhancing native ecosystem liquidity.Furthermore, and following Moonbeam’s strategic expansion plans, there are various opportunities within the restaking space that can be explored with vGLMR which are compelling in creating a flywheel effect that drives adoption, liquidity and rewards supporting ecosystem growth and more importantly the demand and value of its native asset, GLMR.

Liquidity Loan

Amount

Bifrost applies to borrow 5M GLMR (approximately $800,000 as of writing) in liquidity from the Moonbeam Treasury as a 2 year loan and would return its principal in full with interest (roughly 445,692 GLMR) to the Moonbeam Treasury upon loan maturity.

The 2 year loan will be operated in 2 phases as below:

- Phase 1: During the first 11 months, Bifrost receives the total loan in tranches from the Moonbeam Treasury, with the full subsidy amount arriving at month 12. All received GLMR during this phase will be liquid staked into vGLMR.

- Phase 2: From months 12 through 24, the 5,000,000 GLMR subsidy will be evenly split between GLMR and vGLMR, providing liquidity on both Stellaswap and Bifrost Stable Swap.

Check the breakdown here:

(The liquidity proportion and staking rewards may vary significantly; please refer to the actual values for the day.)

Protocols and instruments used

Stellaswap

Stellaswap’s partnership with Beefy Finance provides automated concentrated liquidity pools that manage V3 LP positions to keep them in range at all times. This is where the majority of the subsidy liquidity will be deployed.

For more information regarding the mechanism please check here.

Bifrost Stable Swap

Bifrost dedicated liquid staking Stable Pool was developed to optimise for efficient and low slippage swaps between liquid staking tokens and their original tokens. At present, the vast majority of vGLMR liquidity is on Bifrosts’ Stable Swap in the GLMR - vGLMR Stable Pool.

For more information regarding the mechanism please check here.

No IL (Impermanent loss) Risk in vGLMR/GLMR LP

Due to each vGLMR having one GLMR staked as an underlying, thus the price fluctuation on GLMR reflects the same on vGLMR. Since vGLMR can always redeem GLMR 1:1 no matter how many positions the LP provider eventually withdraws, providing LP will not obtain less asset value than holding positions, so vGLMR/GLMR LP has no risk of impermanent loss.

Managing funds and repayment

Tracking Borrowing and Repayment Process

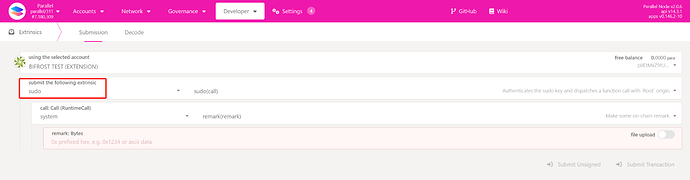

Bifrost will complete the borrowing/repayment process of the 5M GLMR loan through a fully open and transparent process on Moonbeam and Bifrost governance and leveraging off XCM to ensure the borrowing-repayment process is achieved in a completely trustless way. The process is identical to the one successfully used for all 3 Kusama treasury loans and the Polkadot treasury loan.

Borrowing Process

- Moonbeam Side

- Referendum: Apply to the Moonbeam treasury to borrow 5,000,000 GLMR in tranches over 12 months, with ParaId 2030 (12pPnA1aFic3ibBh9xMwssM1779vfrJBxqD4mDy8d18r4g95) as the beneficiary address.

- Root Call scheduler batch call to transfer 1,700,000 GLMR in 1st month and transfer 300,000 GLMR in each month from month 2 until month 12.

Management Process on Bifrost

Phase 1 (month 1 to month 12):

- Root Call polkadot_xcm, transfer GLMR to Bifrost Treasury via XCM each month.

- Stake received GLMR to vGLMR each month.

Phase 2 (month 12 to month 24):

- Unstake 2,200,000 GLMR as long as the month 12 loan received.

- Provide 250,000 GLMR and an equivalent value of vGLMR as liquidity in Bifrost Stable Pool.

- Transfer 2,250,000 GLMR with the rest vGLMR to Bifrost Foundation address on Moonbeam though XCM and provide liquidity in Stellaswap.

Management Process on Moonbeam

- Bifrost Foundation provides 2,250,000 GLMR and the rest vGLMR to Stellaswap.

Repayment process

- Moonbeam Side

- Bifrost Foundation withdraws liquidity position from Stellaswap.

- Send the fund back to Bifrost Treasury via XCM.

- Bifrost Side

- Root Call dispatch Bifrost Treasury execute the following calls:

- Withdraw the liquidity position from Bifrost Stable Swap.

- Unstake roughly 2,127,434 vGLMR to GLMR.

- Wait until the unstaked GLMR is received, transfer 5,000,000 GLMR + 2 year staking reward (roughly 445,692 GLMR) to Moonbeam Treasury via XCM.

Security

Smart Contract Risks

vGLMR is not a contract, but an asset custom to the Bifrost chain. The risk assessment and audit reports can be found in the next section “Audits”. vGLMR is issued by the SLP module, which can only be upgraded by root. The risk of root is underlined in the following section.

Upgradability

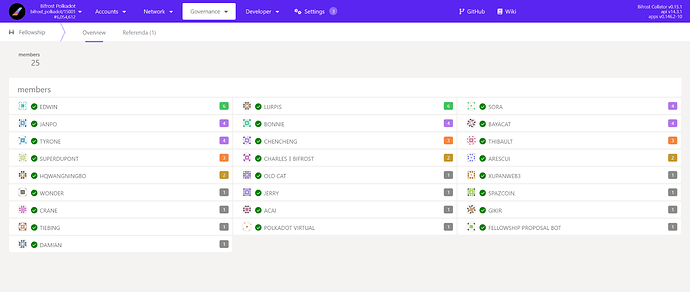

On-chain updates authorised by Bifrost Opengov, with root origin, all root origin calls have to pass through referendums.

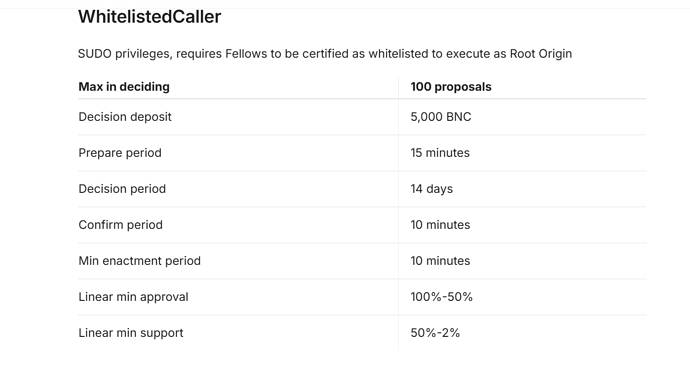

There is only Root Track and Whitelisted Caller Track has the root origin and an Runtime version upgrade should only be posted under whitelisted caller track.

Can Bifrost be manipulated by Gov attack?

Here is a case, Parallel Parachain was under Gov attack.

- Bifrost has removed Sudo key (super administrator, can call any function of a chain.) from day one, but Parallel still retained it, which explored a risk for gov attack.

If you search Sudo under the Bifrost chain, there.is nothing.

There is no chance that an attacker can quickly execute a proposal in a short time window without any team member or community spotting it.All token-related function origins are defined as root in Bifrost, and only Root Track and Whitelisted Caller Track have authority to call them. A Root Track requires approximately 14 days to complete the voting period, and a Whitelisted Caller Track proposal can only be executed if it receives positive approval from two-thirds of rank 3 or higher fellowship members.

Even in the worst-case scenario, if an attacker were to control all fellowship members’ private keys, their whitelisted referendum proposal could still be opposed by BNC holders.

The execution of a Whitelisted Caller proposal depends on voting thresholds and weight requirements. A proposal needs between 100-50% positive votes and 50-2% of total BNC participation over a 1-14 day period. For example, if a proposal needs execution on day one, it must receive positive votes from 100% of participants, with at least 50% of all BNC holders participating. When the voting period moves to day 14th, it needs at least 50% of positive voting with 2% of total BNC participation.

In summary, during the early stage of voting, it would be extremely difficult for an attacker to secure support from half of the BNC issuance. Additionally, both the core team and community would actively oppose such a malicious proposal during the voting period.

No instant upgrade, there must be a time-lock delay, it depends on what democracy track is being used: OpenGov Tracks | Bifrost Docs

All parameters are upgradeable on the Bifrost Chain, this requires a Root via democracy.

Governance v1 Removal

After runtime 17000, Gov1 will be completely removed from the Bifrost chain. Currently, all members of the Council and Technical Committee have been removed. This removal eliminates any possibility of a small group executing root permissions on the Bifrost chain.

We plan to remove gov1-related modules in the runtime upgrade version next month (runtime 17000, March), including but not limited to:

- democracy

- council

- councilMembership

- technicalCommittee

- technicalMembership

Codebase & On-chain Activity

Codebase: bifrost/pallets/slp at develop · bifrost-io/bifrost · GitHub

Audit: Audit Report | Bifrost Docs

On-chain activity: https://bifrost.subscan.io/custom_token?unique_id=asset_registry%2F9658598ef1eace56a0662d4a067a260e42b36f2a&tab=transfers

Audits

Bifrost puts significant emphasis and attention on security. All of Bifrost’s code is open source: bifrost-finance · GitHub

We have our formal documentation describing the mechanism and logic of our protocol, pallets/features and of our liquid staking tokens “vTokens’, that are issued by the protocol.

Bifrost has conducted various full chain security audits for its features and pallets with high quality third party blockchain smart contract security auditors (Slowmist, Common Prefix, Oak Security). In addition we have a dedicated Bifrost Security Evaluation document on the Bifrost Audit Report page that can be looked at.

Bifrost has an open bug bounty on Immunify.

Protocol Emergency Contacts

Lurpis, Co-Founder/CEO : lurpis@bifrost.io

Edwin, Co-Founder/CTO: edwin@bifrost.io

Yancy, Head of Product: yancy@bifrost.io

Ningbo, Core Developer (Pallets): ningbo@bifrost.io

Team

Bifrost has a team of 16 full time members of which 9 are developers, 3 on product and 4 on operations and marketing teams. Furthermore, we have about 6 part-time members.

The majority of the team is APAC based between Singapore, Hong Kong and Mainland China (Shanghai).

Core team leads below:

- Lurpis Wang, Co-Founder/CEO

- Prior to founding Bifrost, Lurpis spent 5 years as blockchain product and development full-stack lead engineer at Sina Weibo. Alongside being Bifrost co-founder, Lurpis is the CEO and Founder of Liebi Technology, Founding Member of PAKA Fund LP, and a Web3.0 Bootcamp instructor.

- Lurpis leads the team and protocol management and oversight, as well as temporarily heads operations.

- https://www.linkedin.com/in/lurpis/

- https://x.com/0xLurpis

- Edwin Wang, Co-Founder/CTO

- Edwin is responsible for advanced technology research, R&D, blockchain node operation and maintenance. He is involved in core product developments in mine pool systems and Polkadot based cross-chain chains.

- ark930 (Edwin) · GitHub

- Tyrone Pan, Head of DevRel

- Specialising in blockchain economics, Tyrone has 5+ years in crypto market experience and 4+ years of blockchain product management experience.

- Tyrone leads DevRel, and product implementations across Bifrost protocol and XCM.

- https://twitter.com/Tyronebrezzy

- Yancy Zheng,Head of Product

- Yancy has over 5 years of product design experience, and 2 years of specific experience in blockchain design and product innovation.

- Yancy is in charge of product as well as UI/UX. In his capacity he advises the team on economic model design and blockchain product design directions as well as is responsible for the brand building of the Bifrost protocol.

- https://www.linkedin.com/in/yancyzheng/

- Thibault Perréard, Head strategy and the Foundation.

- Thibault manages Strategic and Business development initiatives engaging and developing partnerships across blockchain and financial industries i.e. institutions (VCs, HFs, MM, LPs), sourcing relationships with ecosystem projects and protocols as well as identifying new opportunities (investment, revenue etc.) for driving and fostering growth across Bifrost and its ecosystem.

- https://twitter.com/Titi1P

A dedicated core team of members are operating the Bifrost protocol under various sub-fellowships with specific mandates, and responsibilities. Read more here.