Is there a rough estimate how many tokens is/will be, this 1,5%? And how are they being added?

Thnx

Good day there!

Thank you Seppy for bringing this important topic here.

I agree with @seppybaal to reduce 1.5% parachain bond reserve inflation to 0, because:

-

Moonbeam already secured his slot for the next 2 Years with Self-funding until 2025.

-

The Moonbeam Foundation wallet has already 23,436,417.350 GMLR tokens ≈ $5,718,485.833. This means that on TOP of $5.7M after 2 years Moonbeam will get self-funded bond tokens back.

+$6M should be enough to secure the next slot in 2025, right? I highly doubt that the cost for core-time leasing will be higher

-

What about the general inflation of 4% - this should be decided separately based on the Token Revenue Model and the strategic plan development for the next 2-5 years.

With the current supply of 1.09 B, 1.5 % is around 16,350,000 GLMR per year, is distributed in a block basis

I believe that the funds are better directed to the treasury. I am not a fan of the decision regarding additional rewards for staking. Firstly, it is a practically negligible amount. That is, it doesn’t play any significant role for an individual. Perhaps for very large stakers, but do we really have a goal to incentivize players who are already significant? Secondly, these are additional tokens in the market. I would prefer to avoid that at this time. Everything has its time. As practice has shown, staking rewards strongly influence the token price during bear markets. I would even say that, in the end, the tokenomics of most projects proved to be unsustainable in this situation, especially with high staking percentages when supply exceeds demand.

In the treasury, there is a council that can decide at any time how to best use these funds. This would be a more agile decision-making process than relying on the community. If we ever want to change our minds, it would be easier. I also believe that strategically it is better to allocate funds here since this money goes to support the ecosystem, including grants for new projects. So, maybe it’s better if we have more new projects with these funds? Or these funds could be allocated to other ideas aimed at supporting the ecosystem.

Maybe some for ambassadors and their work… ![]()

![]()

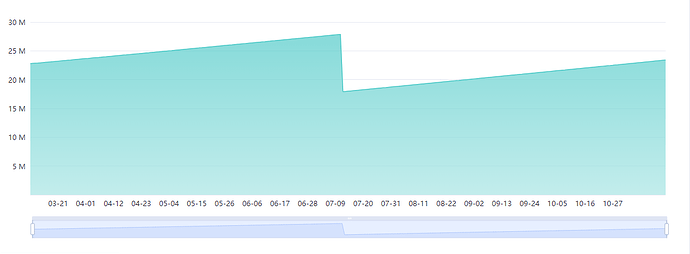

the distribution of the inflation happens on a block-by-block basis. this means that a certain amount of tokens are minted every block, and these tokens are then distributed according to the rules set out in the protocol. following the balance history chart on subscan, we can see that approximately 42-43k tokens are added to the parachain bond reserve daily

Point about Ambassadors… More than Key imho… Let’s carefully consider it.

I don’t know inside MoonBeam, but clearly ambassadors can received more rewards in some ecosystem.

Can be also a great idea.

But attention of people who are ambassador and do nothing or have less knowledge than random user, need to have some control.

Hey all! Great discussion going on here - I love to see all the ideas and different perspectives.

I will follow up with some thoughts on the matter from the Foundation’s perspective in the next day or so - there’s actually been quite a bit of discussion as of late on tokenomics so this forum post is somewhat timely. More to come soon…

Eager to see the foundation’s thoughts/ideas.

I think it’s time to be prepared for the upcoming months, competition is fierce and got to be in the best shape possible.

I think token holders have “suffered” enough over the past months, maybe the switch can be found to start things rolling for token value, revenue, TVL etc.

I will only say that the ambassadors at Moonbeam are really effectively showing themselves. Other projects outside of the Polkadot ecosystem recognize that. I’ve had a couple conversations about it.

And we could really use the funds… Even if that money is pledged in the future, it’s a good motivation. More and more ambassadors are taking on some kind of role in the ecosystem, and soon we’ll have another upgrade program waiting for us. New roles and new challenges.

We have recently cleaned up the list of senior ambassadors and thanked them for their work. There will also be a points system in the future program. So I think it should be fair. We’ve only gotten rewards in the past if we’ve been active. I’m talking about seniors ambassadors. And we also have Community Manager - @_phyn. Who works and monitors our work ![]()

This is partly why I believe that funds should be given to the treasury. Then in the future we will have the opportunity to write a presentation, plans, do a progress report, and submit a proposal for funding. Besides, we don’t need much for the year. Separately, I will say that we are talking about a portion of the funds and a small one.

So, in that case, thanks to the treasury, we are will be still flexible in terms of deciding how to spend those funds. It might be some grant for project, it might be some event… I think in an option like that, the network would benefit more than us spreading that money around to all the stakers.

TL;DR: The Foundation is assessing market dynamics, infrastructure costs, and the tokenomics of the Moonbeam ecosystem. Third-party experts may be involved to propose recommendations for long-term success. The community will have the final say on adopting these recommendations, emphasizing the holistic consideration of all aspects. The study is expected to start in Q1 and conclude during Q2, and has been identified as a high priority initiative for 2024.

As noted above, there’s been a lot of great ideas presented here and it’s good that we have engaged community members thinking about these issues.

From the perspective of the Foundation, there’s been a lot of discussion lately around how to ensure the long-term sustainability of the Moonbeam network while still supporting initiatives to build out the ecosystem and continue to draw in more builders through various programs. Naturally, these conversations can’t occur without the topic of tokenomics coming up.

In these discussions, it has been pointed out that it probably makes sense to consider all aspects of tokenomics built into the protocol as a whole. This includes the parachain bond reserve but also staking/collator reward levels, fees, contributions to the treasury, etc. Moreover, these aspects should be looked at with a long-term view.

To this end, the Foundation has already started an initiative to evaluate the overall market dynamics of the Moonbeam ecosystem, related infrastructure costs and chain tokenomics. This initiative would likely include engaging one or more independent third parties, with a high degree of expertise in these areas, to ultimately come up with a proposed set of recommendations to ensure the long-term success and sustainability of the network. The Foundation is currently in the selection stage, seeking a vendor with a proven track record in the crypto industry.

These recommendations would then be shared with the community for consideration and discussion. Ultimately, it will be up to the community if these recommendations (or some subset) are adopted. However, it’s the Foundation’s view that it would be of great benefit to the community and overall ecosystem if the results of this exercise were considered before making any changes so all aspects are considered holistically.

It is anticipated that this study will begin in Q1 and be completed during Q2. However, timelines are still a little up in the air. Regardless, this has been identified as a high priority initiative for the Foundation in 2024.

So here it comes the liquid staking ![]() solutions

solutions ![]()

Polkadot refrains a lot from pushing liquid staking, they have their own concerns (liquid staking does NOT exist in the official Polkadot staking dashboard).

If tou want liquidity AND network security, then you know what is the current only sollution, promoting liquid staking (for GLMR here).

You can ring at my door as always ![]()

![]() https://Omni.ls

https://Omni.ls

More liquidity will open lending/borrowing options, equal more Defi activities/use cases, etc etc…

So i agree we don’t need extra staking APR, the extra yield should come from Defi activities (LPing ,lending …) for GLMR LST.

Better to reditect these GLMR to grants and incentives to boost devs &users activities.

I would really like to see Moonbeam have some liquidity on other chains. Since Moonbeam is kind of isolated, we should reach out to layer 1’s/ 2’s and provide some liquidity there. The future is multichain, but that starts with us reaching out. The masses aren’t going to suddenly appear on-chain out of nowhere.

I propose that a big % of the available funds is used to reach beyond the Moonbeam ecosystem, incentivize liquidity and show people what we have built. Promote making use of axelar, wormhole and squidrouter to bridge over Moonbeam tokens and expand our community. We really should “ignite” Moonbeam by focusing more on what’s beyond its walls, because at the moment, for a chain with this vision, it is way too isolated.

We have the technology to turn every asset outside of Moonbeam into and XC-variant. This is exactly why we should partner up with teams outside of the ecosystem. Once Moonbeam sees a spike in user growth and activity, we will have the partnerships outside of the ecosystem that we can help out with the listing of their assets on Moonbeam.

I know this probably goes against the vision of some of you, because this would mean fractionalizing liquidity. But if i’m really honest, the liquidity on-chain at this moment is so low that I consider it being worse then fractionalized (no offense to the current DeFi ecosystem on Moonbeam who are doing an exceptional job btw).

I would like to see Moonbeam take the more aggressive approach then playing the waiting-hoping game. I hope some of you understand what I’m saying!

Cheers!

Thanks for the summary, Aaron, and great to hear that the foundation is being proactive with this effort. Also, in reading all the comments, it’s clear that there are a lot of great ideas, but that there is no independent source of input that has the experience to back up statements of what the best path forward is, and so I fully support getting outside help to provide recommendations.

Of course, that needs to be also garnished (sorry, it was Thanksgiving yesterday) with the opinions and chain specific knowledge of the community, so just some thoughts I want to throw out:

-

The one or multiple 3rd parties doing the analysis should provide the community with their credentials so as to build confidence and show they can be trusted as an authoritive source for their work, and hopefully seeking community feedback (since this is a live chain and not in planning) in helping them determine what’s the best way forward.

-

The analysis and recommendations should include what impact they will have on the predicted future cyclical nature of the industry and provide guidance during both bull and bear (peak and trough) time periods.

-

I agree that an analysis of all tokenomics (or any other revenue and expenditures to keep the chain growing that may not even be strictly tied to tokenomics) should be considered in the recommendations, and happy to hear that this is taking place.

I’ll call out that I run CertHum which runs a Moonbeam collator so any changes to collator rewards would impact my business (whether it is recommended to increase or decrease rewards), so there’s a natural bias from my part, but first in my book is what’s best for the chain and its ecosystem, and so absolutely that must be at the forefront.

The Foundation has always been transparent in all dealings with the stewardship with the chain, and I look forward to hearing more about this initiative as Moonbeam moves onwards and upwards.

Interesting take - certainly something worth consideration as we embark on our review!

Thanks for your thoughtful response and words of support.

You make some excellent points and I believe they are inline with the approach that the Foundation plans to take with this investigation/study.

In observing market dynamics, it’s evident that higher inflation does not necessarily deter price growth, as seen with Polkadot. Despite its higher inflation rate, Polkadot experiences significant price appreciation, suggesting that market algorithms and traders often overlook inflation in their analyses. This highlights an opportunity for Moonbeam to adjust its tokenomics. By enhancing staking rewards and potentially increasing inflation, Moonbeam could boost investor satisfaction and stabilize its coin’s market price. Such attractive staking conditions are likely to increase demand, maintaining high liquidity and supporting the coin’s value even amidst inflationary pressures. This approach could drive more robust market engagement and investor interest in Moonbeam.

Your Vision here is quite interesting Mate… When you talk about external ecosystems do you have some specific ideas/suggestions?