StellaSwap: Ecosystem Grant Draft Proposal

- Author - StellaSwapCD

TLDR

-

Primary Goal - Maintain and Grow Activity (active users, transactions, TVL)

-

Project Description - StellaSwap is a hybrid DEX that features a standard, stable and concentrated liquidity AMM to facilitate the most optimal price discovery for assets on Moonbeam. We’re currently the largest DEX on Polkadot, capturing over 60%-75% of total volume across the Polkadot ecosystem

-

Requested GLMR Grant Amount - 2M GLMR

-

Use of Grant - It will be used to continue sustaining the market depth of strategic assets for the ecosystem, as well as solidify Moonbeam’s position as the most popular trading hub on Polkadot via StellaSwap

-

Motivation for Grant Amount- Liquidity depth is a necessary requirement for a robust and efficient marketplace that powers the ecosystem. Not only does StellaSwap accounts for 80%-95% of trading activity on Moonbeam, we’ve become the most popular trading venue for all of Polkadot, accounting for 60%-75% of all trades on Polkadot! The continuation of grants would foster greater market depth via our newly-launched Pulsar + stable AMM and allow vital functions such as the liquidation of underwater loans to occur. We’ve also figured out a way to distribute ALM rewards in a fair and equitable manner.

PROJECT OVERVIEW & TEAM EXPERIENCE

StellaSwap is a hybrid DEX that features a standard, stable and concentrated liquidity AMM to facilitate the most optimal price discovery for assets on Moonbeam. As the largest DEX on Polkadot and an integrated DeFi gateway, users can tap on a comprehensive list of features that simplifies their DeFi experience. Users can engage in trading, liquidity provisioning, bridging, cross-chain swaps, and a whole host of things. Here’s our achievements since inception;

-

Only DEX on Polkadot with over $1.1B in trading volume

-

First DEX to go live on Moonbeam; has been the prominent DEX ever since. At its peak, StellaSwap accumulated over $140M in TVL and had an average daily volume of around $3-$5M. StellaSwap has pioneered several novel mechanisms such as our Initial Liquidity Offering (ILO) to foster capital inflows towards Moonbeam, ZAP feature to facilitate 1-click staking, and we’ve launched the first concentrated liquidity AMM called Pulsar, which is the most capital efficient AMM to date

-

We’ve worked with key protocols such as Moonwell, Lido, Beefy, Qidao, Wormhole and a long list of projects to develop a robust trading venue for the ecosystem.

-

Was one out of 4 protocols that received the subsequent Level 3 ecosystem grants (Tranche #1, March 2023), securing the highest allocation of of grants at 37% (~1.6M GLMR). Continued working with projects in DeFi to spearhead growth within Moonbeam, such as Squid+Axelar for cross chain swaps, cross chain utility with Prime Protocol, a long list of AMMs such as Mellow Protocol, DeFiEdge, Gamma to further simplify V3 staking.

-

We’re made up of a tight knit group of technologists and DeFi natives that previously founded one of the first regulated digital assets exchanges in the Middle East. Our founding team also includes a senior research associate from London School of Economics (LSE). Our team brings a wealth of expertise in digital assets trading and security systems, with prior experiences across high growth start-ups. We have been fully KYC-ed by the Moonbeam team.

PERFORMANCE & ANALYSIS

Before proceeding to deeper details of our proposal, it is only fair that we provide an overview of our performance in the previous grant cycle AKA Tranche #1:

Achievements

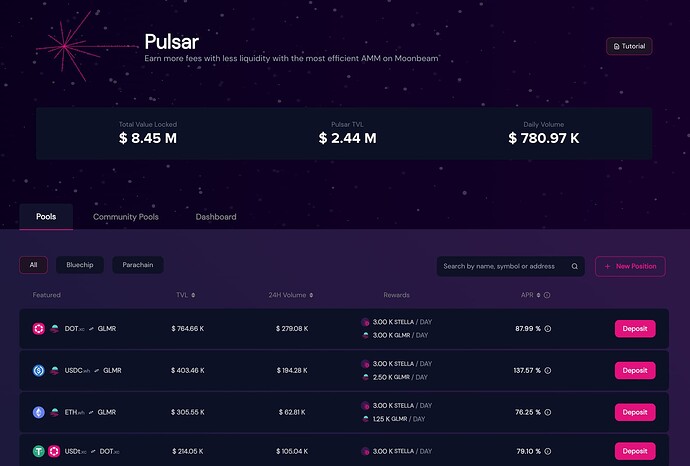

1. Proven Capital Efficiency for Ecosystem Liquidity via Launch of Pulsar

We launched Pulsar at the start of the year to significantly boost capital efficiency for the ecosystem with the most efficient AMM to date. The success of Pulsar is manifested in;

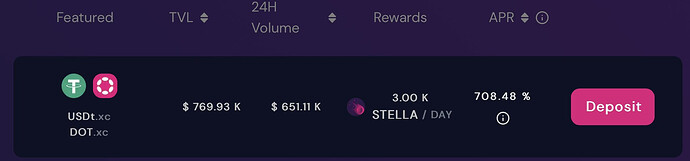

- Average utilization rate of 30% and even peaking to above 100% in some instances (vs standard AMM’s 5%-10%)

- Efficiency rates of 10X - 20X

- Lowest slippage achieved on Moonbeam across all bluechip pairs since network inception, even with lower TVL

- Sustainable yields via trade fee generation

- Launch of Community farms category that feature organic farms

- DEX with the most comprehensive list of assets across Polkadot

2. Strong General Metrics

StellaSwap was the first project that launched the grants immediately in the last cycle. Here’s the sequence of events leading up to the grants and post disbursement;

- March 20: Transition from V2 to V3 started

- April 3: Snapshot voting ended

- April 7: Receipt of Ecosystem grants

- April 10: Disbursement of eco grants on Pulsar farms according to public schedule

For context, we began transitioning our farms from our standard AMM (V2) to Pulsar (V3) well ahead of time on starting on March 20, to ensure the optimal transition of funds by users and to prepare for the ecosystem grants. After 3 days of setting up post grants receipt, we launched eco rewards on Pulsar, ensuring that LPs had immediate access to rewards. Any delays to grants going live would result in capital outflow from Moonbeam, which is detrimental to the ecosystem as the cost of capital acquisition is far higher as compared to the cost of capital transition (V2 > V3). On that front, we’re proud to go live with eco grants as soon as possible.

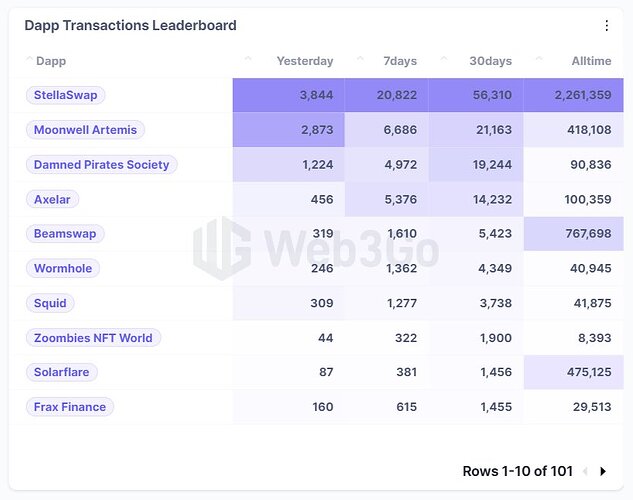

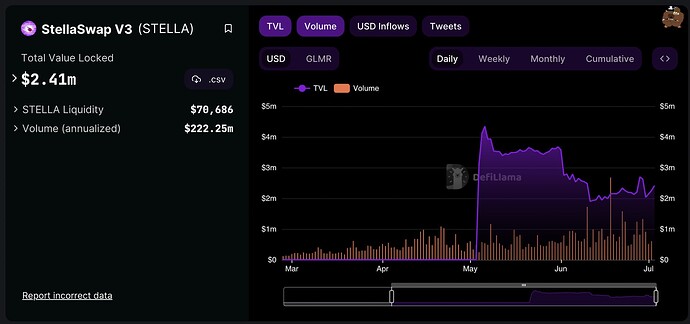

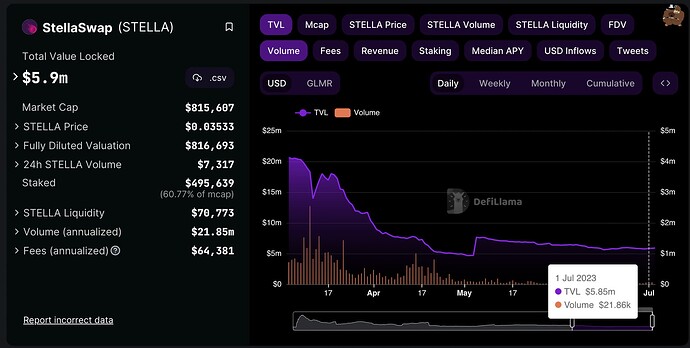

Trading Volume

Across Pulsar V3, standard AMM V2 and stable AMM, StellaSwap is averaging $1m-$3m daily volumes, which represent around 85% - 95% of all trades on Moonbeam. Not only that, we’ve managed to hold the #1 position of the top DEX in all of Polkadot, according to total daily volume. TLDR: The majority of Polkadot users are using StellaSwap to trade!

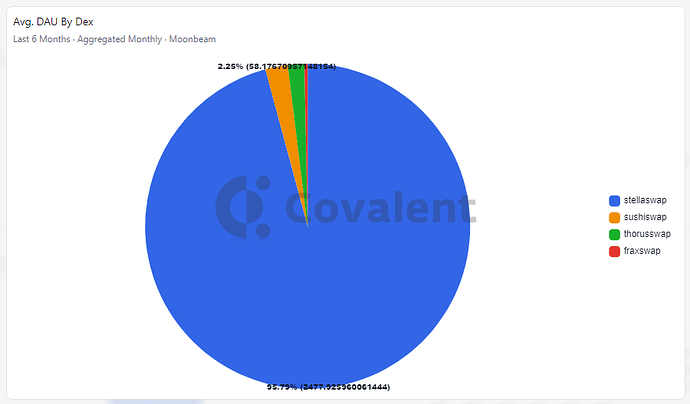

Daily Active Users

As the largest DEX on Moonbeam, we’ve amassed the largest daily users across all DEXs on Moonbeam.

This is further validated by us having the lion’s share of the total transactions on Moonbeam.

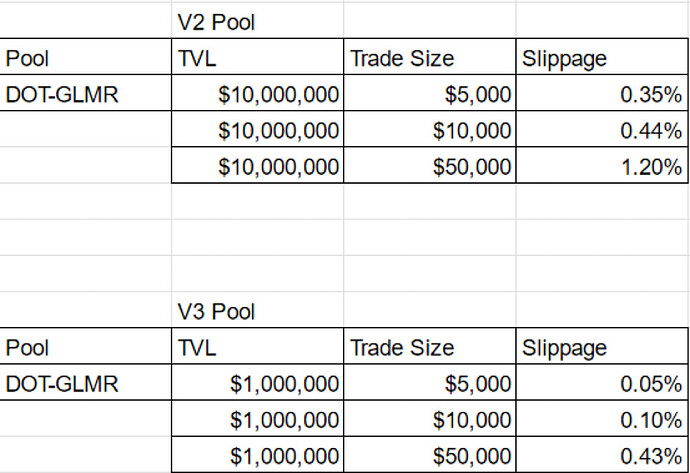

Slippage

We’re proud to have the lowest slippage since Moonbeam’s inception, thanks to concentrated liquidity. Even with lower TVLs due to lower grant amount, slippage is drastically better than our standard AMM V2 farms. Therefore, even with a significant reduction (of over 79%) of our previous grants amount, we’ve managed to ensure the lowest slippage across Polkadot. This strengthens our path towards sustainability and reduction of reliance towards more grants.

Asset Utilization

A relevant metric for the evaluation of a DEX’s efficiency is utilisation rate. This entails the ratio between daily trading volume relative to its TVL; a higher utilisation rate means greater velocity of liquidity to support trades. Having a concentrated liquidity AMM foster greater utilisation rate as the bulk of the liquidity is effective in supporting trade. On average, a standard AMM V2 possess a utilisation rate of 5%-10%. There have been several cases where a farm achieved more than 100% utilization rate!

TVL Performance

Our current TVL stands at around $8.5M, peaking at around $12M in the last few months. To be clear, the drop in TVL for our V2 was completely expected due to the transition to Pulsar V3, as well as a significant reduction on our grant amount in USD in the last cycle. For comparison, we received 79% less grants in USD value in the last cycle compared to the last quarter of 2023, due to a drop in GLMR price and the fact that we received 1.6M GLMR out of the max cap cap of 2M GLMR that was asked.

3. Simplifying User Journey via Key Launches

We launched several features that aimed to simplify users’ DeFi journey to maximize our grants. These include;

- Migrator tool to provide convenience for transition to Pulsar V3 farms

- Pulsar 1-Pager enhancement for better intuitiveness and streamline staking

- 1-Click withdrawal that batches multiple txns into one and save gas by up to 80%

- Significantly reduced Pulsar’s latency to less than a second for values display to maximise loading speed times

- Crosschain swaps on StellaSwap is now the most popular way to send value to Moonbeam, beating out direct bridging

4.Igniting Moonbeam as the Hub

- Launched several key farms that is native to Moonbeam as well as assets from other parachains that included: ZOO, D20, iBTC, INTR, PHA and CFG

- Moonbeam is the top 3 receiving destination for cross chain swaps, thanks to the increasing popularity of cross chain swaps on StellaSwap powered by our close partners Squid + Axelar

- Partnered with Prime Protocol to foster more DeFi usage and composability within Moonbeam

- Partnered with active liquidity managers such as Mellow, DeFiEgde and Gamma to simplify V3 staking

- Integrated with De.Fi, a prominent DeFi portfolio tracker that allow thousands of users to track Moonbeam and StellaSwap holdings

- Integrated with Defispot, one of the largest open aggregator in DeFi, allowing users to be routed to Moonbeam/StellaSwap’s liquidity

RATIONALE

The Moonbeam ecosystem will stand to gain in the following ways;

1. Foster Market Depth

With the next round of ecosystem grants, StellaSwap can maintain ecosystem liquidity depth to foster greater network activity on Moonbeam. Greater market depth facilitates efficient price discovery, which is required for protocols such as Moonwell, Prime protocol, DAM - and a host of DeFi applications - to operate. With incentives, there will be an inflow of new users that will be exposed to the various use cases within the ecosystem, including connected contract capabilities. Developers are more inclined towards building their dApps on a network with critical mass.

2. Efficient Price Discovery

With greater effectiveness of ecosystem liquidity (TVL) on Moonbeam, price discovery for token value would be the most optimal and slippage would be mitigated, thereby resulting in a conducive trading environment for users. Ultimately, end users will reap the rewards from a liquid market on Moonbeam from ecosystem incentives, resulting in lower slippages and a more streamlined user experience.

3. Fostering Flywheel Effects

With an efficient market for price discovery on Moonbeam, it is much easier to foster flywheel effects to the rest of the ecosystem. Asset composability and utility can be maximised, resulting in a more robust DeFi scene on Moonbeam. For instance, StellaSwap’s initial liquidity of native Polkadot assets such as Interlay’s iBTC, Bifrost’s upcoming LSDs (vDOT/vGLMR) would kickstart utility across protocols such as Moonwell & Prime protocol.

WHAT IS PULSAR?

We’re extremely proud to announce the next evolution of StellaSwap: concentrated liquidity. We’ve partnered with Algebra to launch a capital-efficient DEX called Pulsar, which represents a ground-breaking enhancement to StellaSwap’s current hybrid DEX, utilizing the power of concentrated liquidity to provide a much more efficient way of trading and earning as before. With Pulsar, users will access optimal asset prices, low-slippage and greater yield optimization for LP stakers!

Here’s a quick summary of how concentrated liquidity is a beast of AMMs;

-

LPs can provide liquidity with up to 4,000x capital efficiency relative to standard AMMs, earning higher ROIs on their capital

-

Liquidity utilization rates beyond 100%, compared to an average of 5%-10% that StellaSwap currently has. This is good news for LPs as they’ll earn more fees for a given capital base

-

Capital efficiency results in ultra-low slippage trade execution that can surpass both centralized exchanges and stable AMMs

-

LPs can significantly increase their exposure to preferred assets and reduce their downside risk

-

LPs can sell one asset for another by adding liquidity to a price range entirely above or below the market price, approximating a fee-earning limit order that executes along a smooth curve️

-

With greater ROI potential, STELLA emissions can be exponentially reduced. With a reduced inflation rate, we’ll be on the path of tokenholder-value maximization.

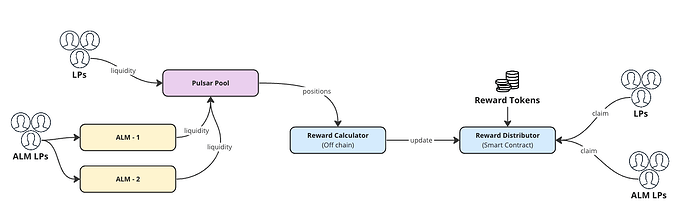

FAIR & EQUITABLE APPROACH FOR ACTIVE LIQUIDITY MANAGERS (ALMs)

As per previous grants, we’ve underlined the importance of working with ALMs to simplify V3 staking, just as Beefy simplified auto-reinvestments of V2 farms. That has been our main priority and we’ve been working closely with several ALMs which include;

- Mellow Protocol

- Beefy

- Gamma

- DefiEdge

- Unipilot

After liaising with these ALMs, we uncovered a core component that needed to be addressed to ensure fairness and equitability: ALM reward distribution. Under current status quo, token incentives are deployed under the ALM. This means for DEXs that that manage their own V3 token incentives like StellaSwap requires another separate “account” on ALMs to disburse rewards for users that are staked via the ALM. This is fundamentally different than the previous status quo on V2, where a V2 ALM equivalent - in the form of Beefy - doesn’t require incentives since the constant reinvestment process under that scenario resulted in cumulatively better yields, in the form of APYs.

Because of the need to have a different set of incentives on an ALM for the same farm, it brings about several key questions that needs to be addressed;

-

How will token incentives be split across direct LP stakes on V3 (e.g. LP on StellaSwap) vs LP staking via ALMs)? What’s considered an equitable balance between both options especially in the context of eco grants?

-

Since it is a zero-sum game (unlike the V2 model where we only need to directly incentivise our farms and Beefy compounds into APYs), how do we deal with the cannabilization between the two sets of users? Emphasising on one set of users compromises on the other.

-

How do we deal with ecosystem grants in such a scenario? For instance, assume we have a 2M GLMR grant and work with one ALM. Will the distribution between direct LP stakes vs LPs via ALM follow our native token distribution? That would halve the impact of ecosystem grants, assuming we’re only incentivising one farm for 1M GLMR and the same farm needs to be incentivised on that one ALM for another 1M GLMR.

-

What about other ALMs? We’re already working with other ALMs, and any incremental ALM in the ecosystem would further depreciate the impact of eco grants. An example is incentivising just 1 farm with 2M GLMR; 666,666 to direct LP stakes on STELLA, 666,666 to ALM 1 & 666,666 to ALM 2? This therefore puts us at conundrum; select 1 exclusive ALM to minimise degradation impact but creating a monopoly or work with several ALMs but maximise inefficacy. In either case, the cons seem to overpower the pros.

The long list of pertinent questions was something that we had to carefully dissect in order to minimise risk and ensure an equitable outcome for all stakeholders. Sticking to the status quo - which means surrendering our control over token rewards to the ALM - would result in the following weaknesses;

-

Complexity in achieving an optimal balance between direct stakes vs via an ALM

-

Cannibalise eco grants usage to a point of inefficient and degraded impact of the said grants, since a single farm (e.g. GLMR-DOT) would require eco grants to be divided between the DEX and across the various ALMs that support that said farm (e.g. Dividing 2M GLMR across the same pool: GLMR-DOT on StellaSwap, GLMR-DOT [Narrow] on ALM 1, GLMR-DOT [Wide] on ALM 1, GLMR-DOT [Narrow] on ALM 2, GLMR-DOT [Wide] on ALM 2)

-

Foster a monopoly of an ALM that prevents a fair/equitable level ground for the rest of ALMs interested in deploying to Moonbeam, thereby forcing users to choose 1 ALM

-

Requires conceiving a separate economic model just for a singular ALM distribution

-

Discriminates against users that want to directly LP and are actively managing their positions

SOLUTION: OFF-CHAIN REWARDER BECAUSE WE WANT FAIRNESS FOR ALL

An off-chain rewarder approach is the best approach to ensure we evade the weaknesses listed above. The plan is to - as best as possible - emulate the V2 staking process where third party managers like Beefy maximise value for users without the need for their own economic model in managing yields. An off-chain rewarder provides for the following;

* One single pool that distributes all the assigned rewards efficiently to both direct stakes in StellaSwap and any other LPs on any ALMs

* All ALMs can receive rewards on their vaults on an equitable basis

* No need to stake tokens anywhere, as long as you’ve provided liquidity you will get reward

* Reduces smart contract risks i.e all LP tokens are locked in one smart contract

* Unlocks a lot of custom reward mechanisms, for example the ability to reward concentrated positions more than non-concentrated ones in a specific ratio, or the ability to award OOR liquidity

Our off-chain rewarder references the ground-breaking work done by Angle Protocol and it is ready to be deployed when the next round of incentives begin.

VISION OF SUCCESS

Our vision is to be the Schelling point for trading on Polkadot. With Polkadot’s Cross-Consensus Message Format (XCM) to unite inter-Polkadot liquidity and the rise of cross-chain connected contract applications to unlock inter-network synergies, our main goal is to harness total interoperability for Moonbeam network.

In order to further work towards our vision, the core of our foundation as a DEX is predicated on providing a robust trading infrastructure that fosters a conducive environment to enable the most optimum price discovery. Once this is established, we can observe the actualization of flyover effects as protocols tap on StellaSwap’s liquidity depth for their corresponding use cases.

As we’ve demonstrated not only the establishment of baseline market depth, the next chapter entails unlocking capital efficiency to ensure ecosystem grants go much further in deepening ecosystem liquidity. The transition of both protocol & ecosystem emissions towards Pulsar will further reduce the cost of trading and would set the stage for sustainable yield generation emanating from organic trade fees. This has been validated via the launch of Pulsar, which has seen tremendous capital efficiency gains in the last month.

RELEVANT KPIs

As part of the continual accountability of the grants process, the type of metrics that are relevant for StellaSwap include;

1) Cost of Trading

The ultimate goal for the usage of ecosystem rewards is to create a conducive market environment that fosters efficient pricing is the cost of trading. This is generally divided into two main components;

-

Trading Fees: One of the core features of Pulsar is its dynamic (variable) fee component, that adjusts itself based on a myriad of factors that include asset volatility, liquidity and trading volume. Based on analytics, Pulsar’s trading fees have been consistently lower than the fixed 0.30% used by other AMMs.

-

Price Impact: The most important metric related to the cost of trading is price impact, which is similar to the notion of slippage on an AMM. Essentially, a more efficient AMM like Pulsar would enable much lower price impact for trades. Pulsar’s efficiency enables ecosystem grants to be more productive in creating a deeper market, which translates into lower price impact. Ensuring price impact is low for trades facilitates greater trading efficacy, which creates a positive loop for liquidity deployment.

Moving towards measuring the effectiveness of liquidity relative to its quantity (TVL) would allow us to measure how far a certain amount of grants has succeeded in creating a conducive trading environment. In order to illustrate this point, we can analyze the current variance of TVL & price impact of pools from different AMMs;

Pool 1: USDC - GLMR

- AMM: Standard AMM

- TVL: $2M

- Price Impact of $5k trade: 0.52%

Pool 2: USDT- DOT

2) Trading Volume

Greater volume indicates greater user activity on the chain, and is perhaps one of the most important metrics to optimize for a DEX. We were successful in attracting volume to the ecosystem as StellaSwap became the first DEX in all of Polkadot to surpass $1.1B in cumulative trading volume.

3) Total Value Locked (TVL)

It is inevitable that TVL is regarded as one of the strongest indicators of popularity and health of any ecosystem. The higher the TVL, the stronger the ecosystem as it is more trusted and reliable. TVL will continue to be an important - but not defining - metric of evaluation. This is because the efficiency that has been proven by Pulsar V3 has reduced the reliance to acquire more TVL, as the main objective for liquidity is to facilitate low slippage. Pulsar V3 has shown that the same degree of slippage can be achieved with much lower TVL.

4) Unique Users

User acquisition is a core metric for growth of any protocol; a growing protocol is attributed - in part - to an increase in the number of users. It is imperative to track and optimize for user acquisition, especially when ecosystem incentives are used. The objective is to attract and onboard as many users as we can onto the Moonbeam network.

USE OF GRANTS TIMELINE

It must be emphasized that the totality of the 2M grants will be used to incentivize farms on both Pulsar & stable AMM to maintain liquidity. Under no circumstances would any of the grants be used for development or any other purposes beyond incentivizing the farms, which goes to LP stakers.

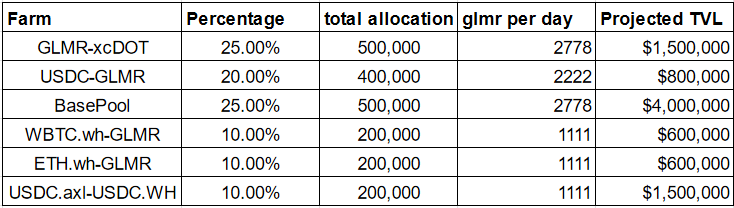

This current round of grants will run for approximately 6 months, and will be used to continue incentivizing strategic farms. Strategic farms are made up of assets of strategic importance, which are in the form of blue-chips. It is imperative that current baseline liquidity is maintained so as to ensure the full-functioning of the ecosystem without any capital leakage. Here is the breakdown of the farms and their corresponding rewards that will be incentivised in this grant cycle;

The strategic farms represent a similar list to the previous grant list. Our aim is to stretch the ecosystem rewards for up to 6 months. We believe that the grants for this cycle will go a long way in maintaining the current level of market depth and to prevent capital leakage.

Contingency Plan

As GLMR (incentive) represents a finite resource that must be effectively deployed, StellaSwap must be ready to deploy a contingency plan in the event of a black swan. The main concerns around pausing or stopping emissions due to adverse market conditions is as follows;

- If LP’s know there’s a possibility of disruption in rewards they won’t bring it to being with and the campaign won’t be successful

- We have seen that it is more expensive to attract liquidity back thus offsetting any “savings” in pausing

With that in mind, we believe that any stoppage to the emissions should only occur in a scenario similar of that to what we experienced;

- In the event of a black swan where a security incident that resulted in the de-pegging of an asset, StellaSwap will cease emissions into the farm until there is clarity on next steps, whether it be post-resolution or deprecation.

Additionally, it should also be mentioned that our targets and objectives will be pro-rated in accordance to the amount of grants we get. For example, if we get 50% of the $2M cap, then our target metrics will be halved in accordance to the discount in value that we receive in grants.

KPI MILESTONES

This section tracks the relevant metrics that will give rise to the success or failure of our grants. As seasoned applicants of the grants program, we’re dedicated to tracking the most pertinent metrics that evaluate the efficacy of grants usage. A main metric that we look at is Grant/TVL Ratio. For context;

Grant to TVL Ratio (Mar 2023)= 56X

Previous Grant: 1,677,150 GLMR

Value at time of receival: $637,317

Value today: $452,662

Max TVL Achieved: $12M

Grant to TVL Ratio = 56X

Grant to TVL Ratio (Oct 2022)= 54X

Former Grant : 7,833,600 GLMR

Value at time of receival: $3,086,928

Value today: $2,114,287

Max TVL Achieved: $28M

Our target for this grant cycle is to achieve an efficiency factor of 52X or less. What this metric effectively means is that for every $1 of ecosystem grants that we receive we’ll get more TVL.

The Projected TVL that we calculated was based on a conservative schedule, and with an efficiency factor of 52X or less we’re aiming towards a TVL of close to $10M. The other core metric that will be tracked is Daily Volume.

Our goal is to foster greater trading volume from greater liquidity efficiencies, product launches and partnerships with projects/ecosystems. From a current average of $1M daily, we aim to raise the average daily volume by 50%-100%.

In addition, here’s the following targets for user growths, which is manifested as unique addresses;

- 15% growth for Unique Addresses interacting with StellaSwap in the next 6 months

STEPS TO IMPLEMENT

Similar to the previous grants, our infrastructure is ready to receive the grants at any point of time and go live. We strongly believe that grant recipients should distribute ecosystem grants immediately and in unison to maximise the impact for the ecosystem, and that is what we will continue to do. Here’s the breakdown of steps for disbursement upon successful grants acquisition;

- Receive ecosystem grants to our public multi-signature address

- Transfer ecosystem rewards to rewarder contract for distribution to LP stakes

- Launch off-chain rewarder to facilitate equitable reward distribution across direct LP stakers & ALM shakers

We will ensure that there is no lapse of ecosystem rewards between the previous and current cycle to ensure no liquidity leaks from the ecosystem. In the event that we receive lower than our initial ask of 2M GLMR, then our target metrics will be adjusted on a pro-rated basis, especially with regards to TVL. The adjustment will be mainly based on the USD value of the grant at the point of disbursement.

SECURITY

Security is a core aspect of StellaSwap that deserves a section on so that the community can appreciate the processes that we’ve established. Here is a list of security mechanisms on StellaSwap;

- All our AMMs have gone through full audits via Certik & Solidproof

- Pulsar has been audited by ABDK consulting & Hexen. We partnered with Quickswap to do an additional layer of audit on Code4rena before deployment

- We have one of the highest bounty in the ecosystem on ImmuneFi across Critical & High

- Users can also insure their positions on LP of up to $1.5MM in capacity on InsureAce, covering SC vulnerability.