We are excited to announce an upcoming on-chain vote to allocate the third season of our ecosystem grants, totaling 4.5 million GLMR, strategically guided by the recommendations provided by Gauntlet. This initiative represents a significant step forward in the growth of the Moonbeam ecosystem.

Vote Details:

-

Budget: 4.5 million GLMR

-

Start Time: Thursday, May 30th at 14:00 UTC

-

End Time: ~Thursday, June 6th

-

Track: Fast General Admin

-

Voting Platform: Moonbeam On-Chain Governance vote

Voting will be a single vote to approve the entire budget allocation and will be a simple Aye/Nay vote on Moonbeam. The vote will use the new Fast General Admin track and the OpenGov support curves. In principle this makes it a 7 day vote, although it could complete earlier if there is a lot of support. Please note that there is no Snapshot vote this time around.

Grant Distribution:

The distribution of the third season grant budget is based on the recommendations provided by Gauntlet. If approved, the grant funds will be distributed as follows:

-

1,350,000 GLMR (30%) to Stellaswap (DEX)

-

1,125,000 GLMR (25%) to Moonwell (Lending Protocol)

-

1,125,000 GLMR (25%) to Prime Protocol (Cross-Chain Interactions)

-

900,000 GLMR (20%) to Beamswap (Innovative Products)

Recipient Responsibilities:

Incentive Readiness

All teams receiving grants should comment on this post by May 29th to confirm their readiness to launch respective incentives on Friday, June 14th. It is crucial that each team is fully prepared to utilize these funds effectively immediately upon receipt, in alignment with Gauntlet’s strategic recommendations to maximize grant impact.

Grant Evaluation Framework:

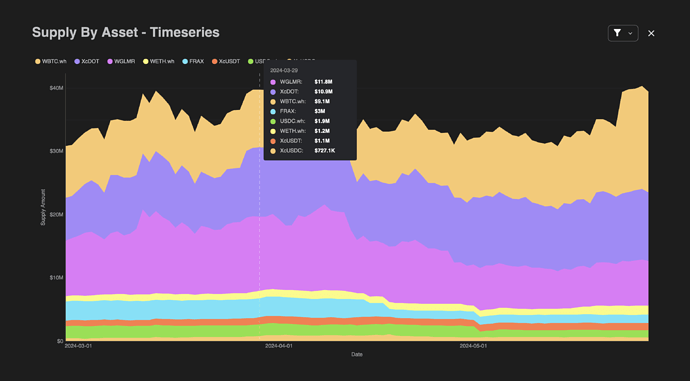

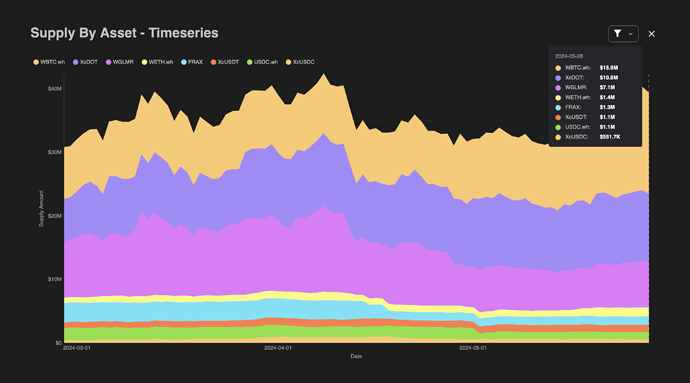

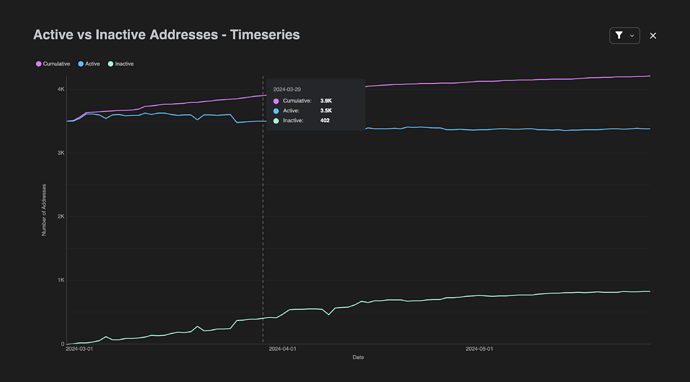

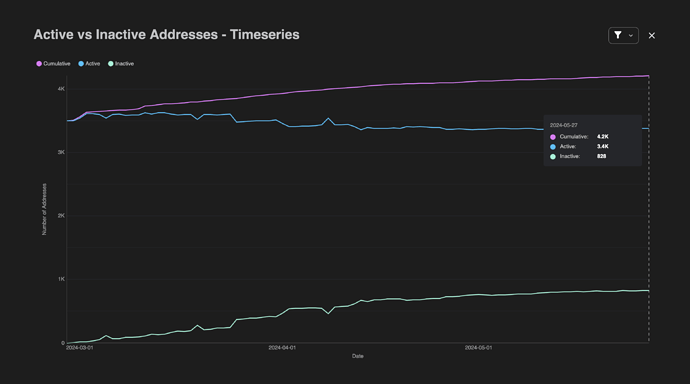

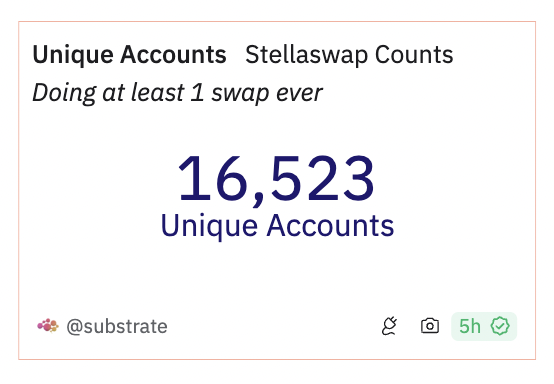

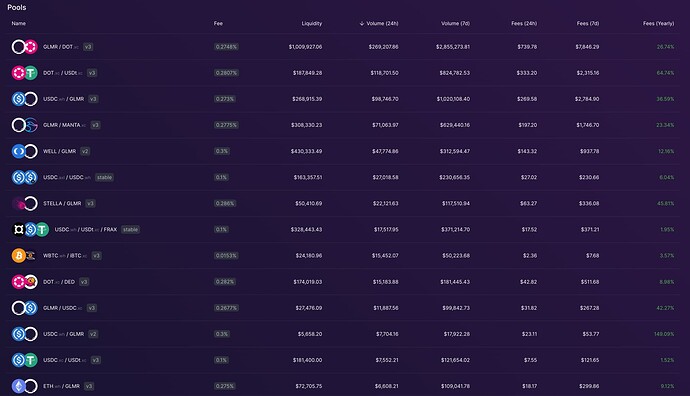

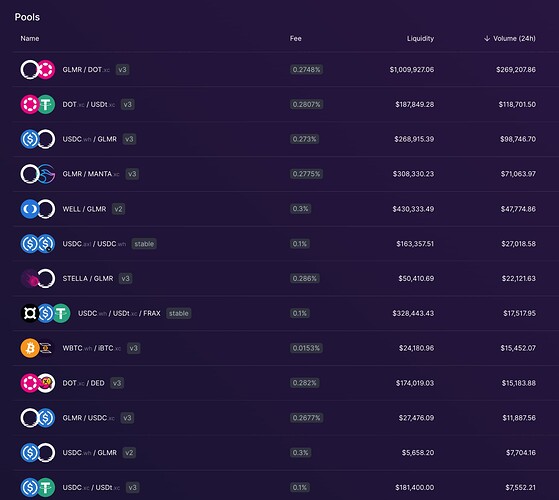

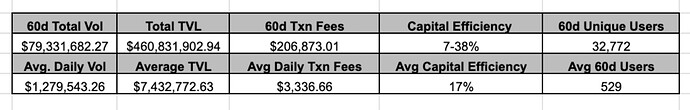

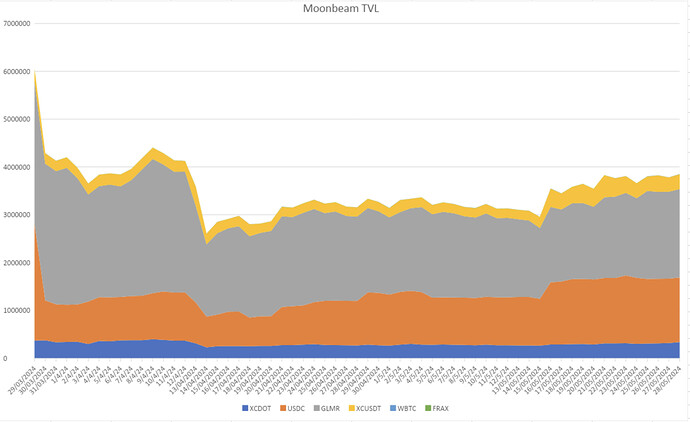

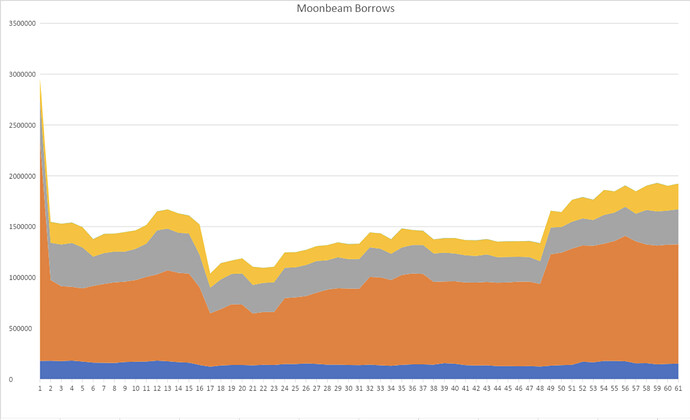

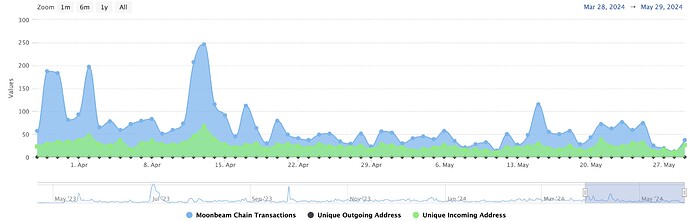

Following the guidelines of Gauntlet’s ecosystem grant evaluation framework, each team should share key metrics for their protocol to capture the 2 month “before” period of the grant cycle. These are the mean values between March 29th, and May 28th, 2024 for:

-

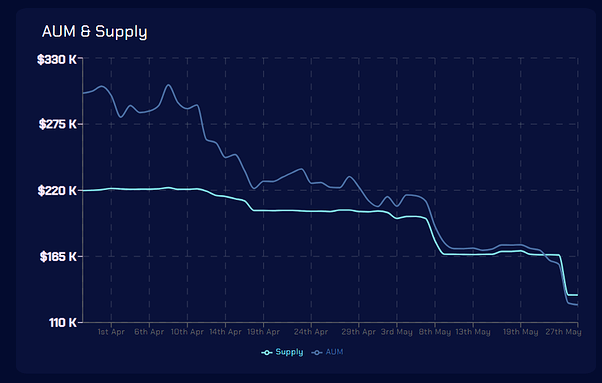

TVL: the total USD value locked within the protocol, indicating the amount of capital deposited by users

-

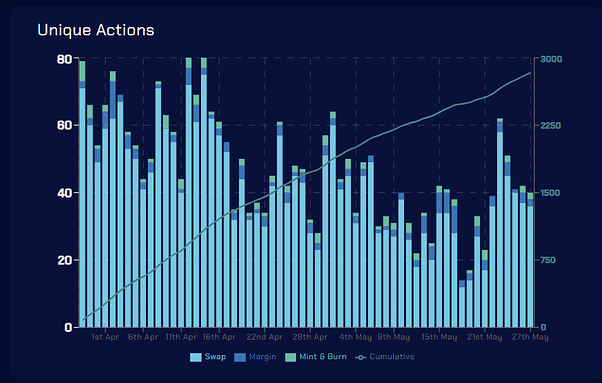

DAU: the number of unique users who interact with the protocol within a 24-hour period.

-

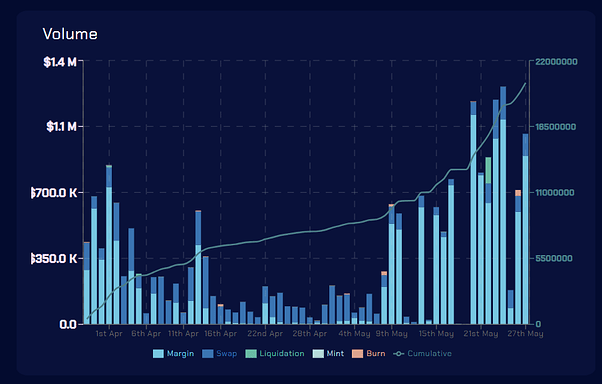

trading volume: the cumulative value of all trades executed on the platform, converted to USD

-

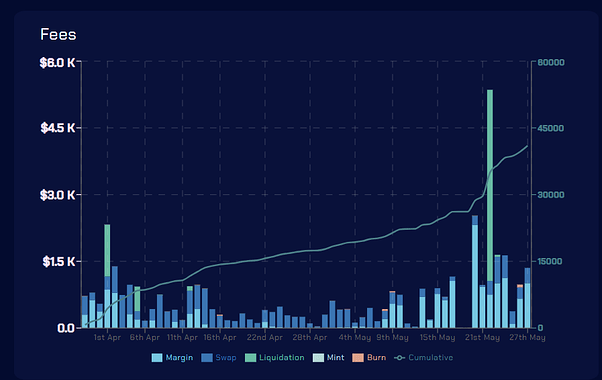

trading fees: The total fees collected by the protocol as a percentage of the trading volume

-

capital efficiency: The ratio of trading volume to TVL, indicating how effectively the protocol uses its locked capital to generate activity.

Teams should also share plans indicating which pairs they plan to incentivize, and intended goals for the above metrics. This data should be shared by May 29th, at the latest.

Going forward, teams should develop a publicly available rest endpoint so this data can be easily collected.Upon completion of the grant, the foundation will collect these same metrics from teams for the 60 day period after completion of the grant, i.e. the period between December 14th 2024, and February 15th, 2025. This will let the foundation assess the impact of the grants and share a comprehensive report with the community.

Important Dates:

-

Teams signal readiness: May 29th

-

Teams share key metrics: May 29th

-

Start of the vote: May 30th

-

End of the vote: ~June 6th

-

Funds Distribution: Monday, June 11th

-

Incentive Launch Deadline: Friday, June 14th

We encourage all community members to participate in this crucial vote. Your involvement in allocating a significant portion of the token supply directly impacts the strategic direction of our ecosystem’s growth.