Proposal to list GLMR on the HydraDX Omnipool

[Status: Idea]

Requested Amount: 500,000 GLMR (~$110k at time of writing)

Note: These funds will remain in control of Moonbeam governance.

Abstract

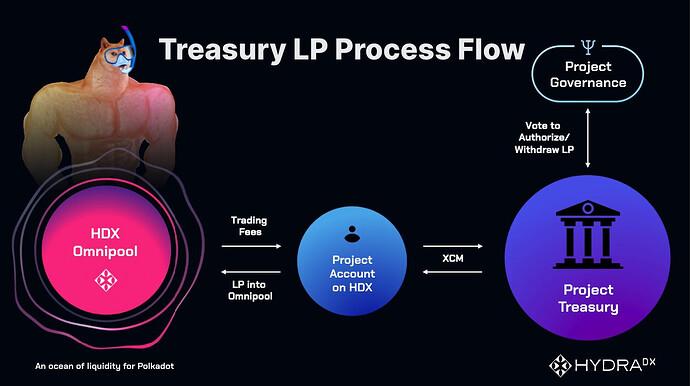

We propose to use GLMR from Moonbeam treasury and provide it cross-chain into the HydraDX Omnipool as an LP position controlled by the Moonbeam governance. The intent is to seed initial liquidity and start trading GLMR in the HydraDX Omnipool natively and efficiently within the Polkadot ecosystem.

Motivation

Users will be able to trade native GLMR within the dotsama ecosystem.

Omnipool will allow:

- Trading GLMR vs. any other asset in the Omnipool (currently HDX, DOT, DAI, ZTG, wETH, iBTC, wBTC, native USDT, ASTR + a lot more in the pipeline)

- Single-sided LPing

- OTC trading

- Cross-chain transfers

- Liquidity-mining

In a very short-term horizon (expected June 2023):

- DCA (dollar-cost averaging) - allowing your supporters to gradually accumulate GLMR during the bear market

- Dynamic fees - improving potential profitability of your position in the Omnipool

In mid-term horizon:

- Stableswap pools

- Order batching

- Staking

Project Overview and Team Experience

HydraDX is a next-gen DeFi protocol founded in 2020 which is designed to bring an ocean of liquidity to Polkadot. Our tool for the job the HydraDX Omnipool - an innovative Automated Market Maker (AMM) which unlocks unparalleled efficiencies by combining all assets in a single trading pool.

Video content:

Kusamarian - HydraDX overall

Kusamarian - HydraDX usage & efficiency

Rationale

Cross-chain communication and cooperation is one of the core principles of Polkadot. Both sides, the Moonbeam DAO and HydraDX DAO, will benefit from moving this proposal forward. With growing liquidity and number of listed assets in the HydraDX Omnipool, everyone will be able to gain access to a decentralized, permissionless and frictionless way to trade (or accrue value of) GLMR with high capital efficiency and low slippage.

Key Terms

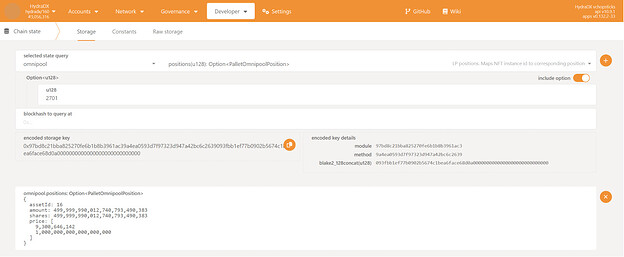

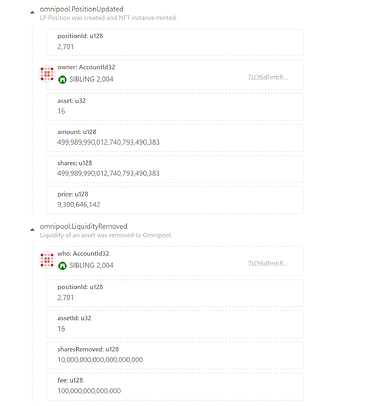

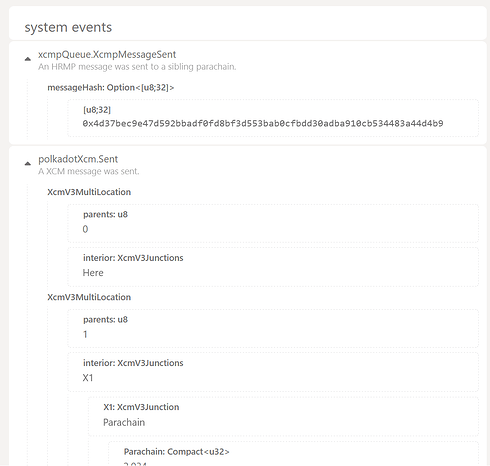

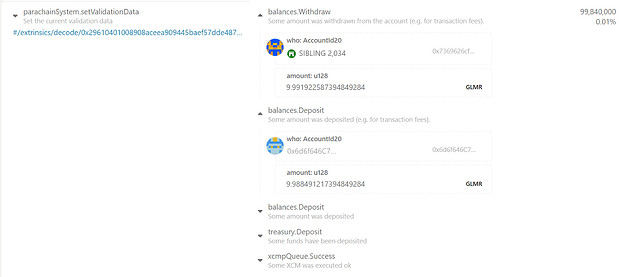

GLMR will be provided as an LP position into the Omnipool - trustlessly and without losing control of the funds. The GLMR position can be withdrawn at any time by the Moonbeam governance and GLMR sent back to its treasury. All made possible by XCM.

Important fact to realize is that this model is superior to alternatives, where teams have to spend capital to be listed on CEXes or aquire the other half of the pair for seeding common fragmented XYK pools on other DEXes.

Overall Cost

There is no direct cost for the treasury. The LP position if withdrawn can end up in a profit or loss which depends mostly on accrued trading fees and Impermanent Loss in Omnipool suffered during LPing.

Use of Treasury Funds

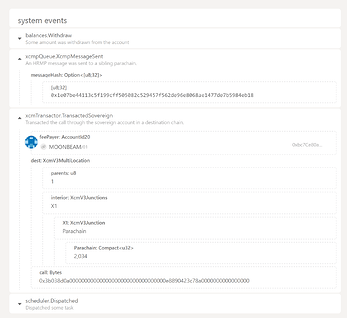

- Moonbeam governance approves & executes a proposal to send 500,000 GLMR via XCM to the [HydraDX Omnipool account] (7L53bUTBbfuj14UpdCNPwmgzzHSsrsTWBHX5pys32mVWM3C1, a system account with no private key)

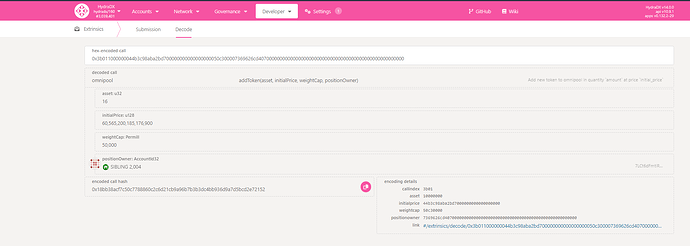

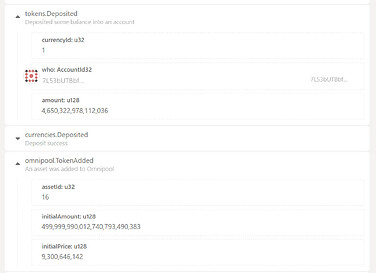

- HydraDX governance launches a council motion which is fast-tracked and enacted in 3-4 hours

- After step 2 is complete, GLMR becomes tradeable within the Omnipool. Sender (i.e. Moonbeam sibling account 7LCt6dFmtiRrwZv2YyEgQWW3GxsGX3Krmgzv9Xj7GQ9tG2j8), is set as the LP position holder so the position can be controlled via XCM Transact calls.