Prime Protocol: Ecosystem Grant Draft Proposal

Prime Protocol Team

Supporting the Prime Protocol Launch with Ecosystem Incentives

Primary Goal

Building Connected Contracts Use Cases (using XCM and other message passing protocols)

Project Description

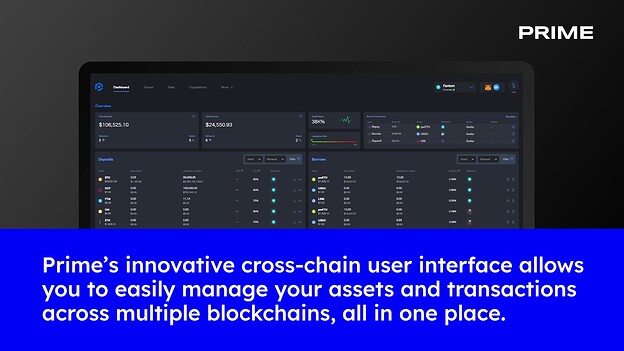

Prime Protocol is an xApp/Connected Contract which allows users to borrow across chains backed by their entire portfolio of cross chain assets. The protocol uses Moonbeam as a hub to allow users to deposit assets from any chain supported on the platform, and borrow assets from any other chain on the platform based on their overall account value. This technology is revolutionary in the crypto space, and it will comprehensively change the way users can get more value from their portfolios. Our vision is to facilitate the spread of wealth across the crypto ecosystem by reducing friction and fragmentation between chains. Prime users can utilize Universal Access to originate their transactions for any chain on Moonbeam, ultimately allowing users to save time and money while still borrowing assets between chains. The project has gained significant traction with the community, seeing over 31k testnet users.

Prime Protocol is the ultimate showcase for Moonbeam's connected contracts. To strengthen Moonbeam's position as a cross-chain hub, Prime Protocol has launched several community activities, including:

- Supported Moonbeam at crypto conferences such as Polkadot Decoded, EthDenver, and SXSW, highlighting Prime as an example of Moonbeam's next generation of cross-chain applications.

- Organized a cross-chain interoperability YouTube discussion panel with Derek, CEO of PureStake (core contributor to Moonbeam), and other prominent projects in the interoperability space such as ZetaChain, Axelar, and Connext to showcase Moonbeam and Prime to the cross-chain community.

- Published a blog post about Prime using Moonbeam as a "home base" for coordination between chains.

- Actively participated in AMA's with the Moonbeam and DotSama communities to engage with the community, attract users, and help them understand the intricacies of cross-chain technology.

- Collaborated with DTMB & Moonwell to launch Moonbeam’s DeFi Voyage NFT campaign, an initiative designed to increase engagement and promote activity within the ecosystem.

- Actively engaged with Moonbeam ambassadors and interviewed on Moonbeam Communities YouTube channel to engage the community and explain the cross-chain architecture of Prime, highlighting the use of Moonbeam as the nexus point for unifying functionality across the many chains.

- Ran the Prime Pioneer NFT giveaway with Moonbeam and offered a whitelist for Prime Pioneer NFT to all Moonbeam Ambassadors.

These initiatives aim to foster the growth and development of the Moonbeam community and its ecosystem.

Test the application on testnet here.

Read more about Prime Protocol here.

Track the latest Prime Protocol developments here.

Requested GLMR Grant Amount

Ecosystem Grant Maximum [2mm GLMR]

We plan to apply for grant maximums for every other chain we will deploy on. Because Moonbeam is our hub and first deployment, we are first seeking a grant from the Moonbeam Foundation.

Use of Grant

Liquidity incentives on Moonbeam to encourage healthy use of the protocol. Users who use Prime Protocol on Moonbeam will be incentivized to do so with higher yields on deposits, as well as subsidized borrowing rates. Specifically, the Grant will be used to incentivize borrows and/or deposits on the following markets, with percentages indicating what percentage of grant funds will be used on each market:

- USDC.wh - 40%, target TVL of 8mm

- xcUSDT - 35%, target TVL of 7mm

- GLMR - 15%, target TVL of 2mm

- xcDOT - 10%, target TVL of 2mm

These allocation figures are not final, because we cannot entirely anticipate demand curves for every pool. The TVL targets are assuming pools will have greater than a 15% yield (which is higher than many of the Moonwell pools), and if they are reached with lower yields then incentives will be tapered to extend the grant runway. Allocation to these markets may be adjusted to maximize the TVL, usage, and health of the protocol. While our conservative estimate is that this grant will be used over a span of three months, it is highly likely (especially for stablecoin pools) that lower yields will be sufficient to incentivize our TVL targets and we will be able to make the grant last for longer.

Motivation for Grant Amount

Cross Chain Connected Contracts are a main focus for the Moonbeam Ecosystem, and Prime Protocol is a leading implementation of a cross chain xApp. This grant will not only serve to supercharge liquidity on the Moonbeam deployment of Prime Protocol, but encourage the use of connected contracts on other chains to interact with the Moonbeam Ecosystem. Universal Access will enable non native Moonbeam users to directly access and interact on Moonbeam, creating transactional volume as well as drive new daily active users for Moonbeam.

Project Overview and Relevant KPIs

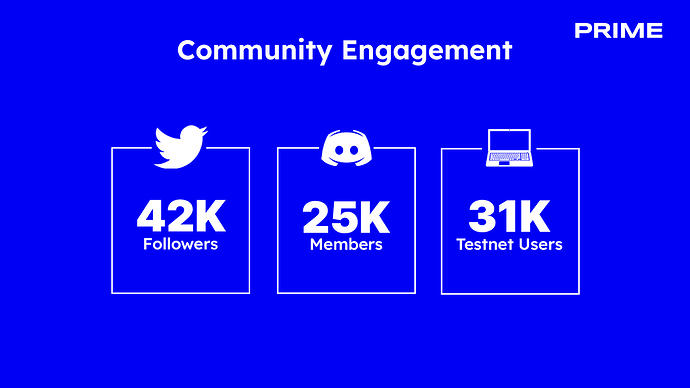

Our protocol has garnered significant attention in the space, accumulating 42k Twitter followers, 25k Discord Members, and over 31k unique users to date on testnet. We expect to gain significant traction on mainnet given the rapid growth and impressive engagement of our community. Much of our ecosystem and community is Moonbeam native, and we will drive direct attention to the Moonbeam ecosystem with significant co-marketing collaboration efforts during our launch. In short, a stronger demand for Prime will directly correlate to a stronger demand for the Moonbeam ecosystem.

Team

The Prime Protocol team consists of 6 engineers and two Ecosystem and Community builders. The team has a wide range of expertise in finance, software development, and crypto. Below you can see some of our team member’s impressive backgrounds:

- Colton Conley

- Colton got his start in crypto in 2016 as an investor and trader. He built arbitrage bots to trade between various centralized exchanges, and became interested in the DeFi space with the advent of decentralized exchanges. He earned a B.S. in Statistics and Data Science and Economics at Yale University, where he was awarded the Tobin Fellowship for economics research, focusing on cryptocurrencies. He has experience working on macro desks at JP Morgan and Citadel, where he was a quantitative trader focused on interest rate volatility. As an avid DeFi user with traditional finance experience, Colton saw the need for Prime Protocol through his own trading activities. He is the Founder and CEO of Prime Protocol Inc., the software development company building Prime Protocol.

- Neeraj Kohirkar

- Graduated from UC Berkeley. Engineering lead at Netflix for 4 years. Advisor for fintech seed-stage startups. Entrepreneur for 10 years. Crypto enthusiast, builder, and investor since 2017. Hobbies include singing Bollywood songs and producing music

- Marcin Pawel

- Former member of the Vega Protocol's community team, Kitefin.xyz co-founder, entrepreneur, and advisor. Crypto enthusiast since 2016, BSc Computing & Business, OU Milton Keynes, England

- Noah Bayindirli

- Noah is a fullstack engineer and crypto-native developer, with extensive smart contract and decentralized infrastructure experience. After honing his skills at Amazon, Noah shifted all focus to DeFi to join Prime and help develop the next generation of our monetary system.

- Francisca Moya

- Francisca is a Data Science and Physics graduate from Wellesley College and an alum of the Bernard M Gordon MIT Engineering Leadership Program. She is a software engineer at Prime Protocol focusing on front end development. Francisca is passionate about building scalable interfaces that adapt to the rapidly changing business needs of DeFi. She believes these platforms should be accessible and easy to use by users with diverse levels of expertise in Web3.

- Tyler Galaskas

- Former Digital Content Producer abc27 News, Crypto community organizing, Crypto enthusiast since 2017. Social Media Manager for Prime

- Thomas Baker

- Thomas recently graduated from Georgia Tech with a major in Aerospace Engineering and a minor in Computing and Intelligence. After working on a MEV arbitrage team with students from Blockchain @ GT and helping to plan the Web3 ATL conference he joined Prime as a Blockchain Engineer.

Project Architecture

Hub and Spoke Architecture

Prime Protocol uses a hub and spoke architecture as a part of its connected contracts approach. Moonbeam serves as Prime’s hub, allowing for the protocol to connect with other major ecosystems through decentralized message passers, while also connecting with other parachains in the ecosystem. Every time a user conducts an operation – even if they are depositing or borrowing on a different chain – a transaction is executed on Moonbeam to certify that change of account state. The vast majority of protocol logic lives on Moonbeam, and most of the gas required to power Prime Protocol is spent on Moonbeam. As adoption for Prime Protocol grows, usage of the Moonbeam Network grows too. Furthermore, by leveraging Moonbeam as a hub, Prime Protocol can accept xcAssets as collateral and can deploy to other parachains leveraging XCM. Prime Protocol’s go to market strategy involves first bringing liquidity to Moonbeam and Polkadot through connections with external EVMs. Then, Prime Protocol can serve as the lending protocol for all of Polkadot as well.

Message Passing

Prime protocol utilizes generic message passing protocols to connect with chains outside the Moonbeam Ecosystem. A large advantage of using Moonbeam is that these message passers can easily connect with Polkadot through Moonbeam because of the EVM compatibility Moonbeam offers. To ensure robustness of the protocol regardless of what the future may hold, Prime Protocol features a router and standard messaging interface that can plug into any interoperability protocol. All user flows that may require a message to be passed – deposit, withdraw, borrow, repay, and liquidate – are packaged into a payload and sent to and from Moonbeam via a generic messaging protocol. Before a message is sent, a unique hash of that message’s payload with some metadata is stored on the sending contract. This ensures there is a record of the messages queued for delivery, so if anything were to go wrong with the message delivery, the tokens locked on the sending chain are not lost. For example, if the chosen message passer is paused or exploited, the messages could be routed over a different message passer to ensure delivery. On the receiving side, a queue of message hashes are stored to prevent replay attacks, and ensure every message received is processed exactly once. This means that a message that failed to deliver or was delayed could be re-sent over a different route. It also offers protection against one of the most common forms of bridge hacks. Currently, Prime leverages Axelar to securely deliver these messages and Wormhole as an alternative route. Both Axelar and Wormhole are excellent solutions, and the integrations with each have been fully audited. There has never been an issue with the consensus mechanism for either protocol, and the relayers they use are completely trustless. Prime Protocol does not rely on any token bridges, only the core message passing layers.

Money Markets

Prime Protocol will launch with pool based money markets, where users can deposit tokens and use them as collateral for other users to borrow against. What makes prime protocol different from any existing money market is how every pool is connected to one another regardless of blockchain. So, a user could deposit on ETH and borrow on Moonbeam, without sending tokens over a bridge. If a user has assets on both Moonbeam and ETH, all of those deposits can count as collateral for a single (or multiple) borrows on any chain in the network. This model of interoperability is revolutionary from both a UX perspective and a financial utility point of view, because the ability to use every asset in one protocol allows users to benefit from having a diversified portfolio.

CDP

Prime Protocol also has the ability to issue synthetic assets, pegged to the price of an asset such as USD. While these will not be made available right at launch while efforts are concentrated on building usage of the money markets, down the line USP and other synthetic assets can provide decentralized alternatives to tokens such as USDT in the Moonbeam ecosystem and beyond.

Sources of Revenue

Prime Protocol generates revenue in the following ways:

- Interest

- Like other borrowing protocols, Prime receives a share of the interest borrowers pay on the platform.

- Liquidations

- When a user is liquidated, a penalty is applied to the seized collateral in the form of a liquidation fee. Most of that fee is used to incentivize the third party liquidator, to ensure the liquidation is performed promptly. Part of that fee is reserved by the protocol.

- Swap Fees

- When the stablecoin goes live, Prime will allow users to swap USDC for USP through the protocol treasury reserves. There is a fee applied to these transactions, which generates a profit for the protocol. It is important to note that even in a depegging event for USDC, this would not affect the security of a user’s deposits because those losses would be entirely absorbed by the protocol treasury. We believe that given the move of USDC’s cash reserves to BNY Mellon, the risk of a depegging event due to insufficient reserves is extremely small compared to when those reserves were sitting in regional banks uninsured.

Costs to Users

Users will pay gas costs to use the protocol, as is customary with all DeFi protocols. Moonbeam users will have the unique advantage of not having to pay additional gas for message passing outside of Polkadot, which will significantly reduce both transaction costs and latency. This perk is specific only to Moonbeam users, because it is our hub chain. Other costs users will face include the aforementioned sources of revenue. A small portion of interest paid will be collected by the protocol, and liquidations also charge a penalty. These fees are consistent with industry standards and other liquidity protocols.

On/Off Ramps

We are working to make Prime Protocol as accessible as possible to new entrants to the Moonbeam Ecosystem. To that end, we will be working with multiple on-off ramp providers to build native integrations into the protocol, so users can deposit and withdraw directly from their bank account or credit card. These collaborations will be announced shortly, and are anticipated to be live a few months after mainnet launch.

Synergies with Moonbeam Ecosystem

There are multiple potential synergies with the other projects in the Moonbeam Ecosystem. On the Prime Protocol UI, we plan to integrate swapping and bridging interfaces, powered by Moonbeam native DEXs. Liquidators will also need to use Moonbeam DEXs to swap out of the Moonbeam native collateral they seize. In the future, once price oracles are available and security due diligence is complete, Prime Protocol could support LP tokens from projects such as StellaSwap and Beamswap as collateral, as well as the CTokens from Moonwell.

Sources of Real Yield

Incentives from ecosystem grants and native token rewards are a bootstrapping mechanism to assist in early acquisition of liquidity, but certainly not a long term plan for user retention. Prime Protocol is built to take a variety of collateral types, which will allow for users to earn yield from other protocols while simultaneously using that capital to collateralize a borrow. These use cases include liquid staking, Compound cTokens, AAVE aTokens, and LP tokens. Any such yield bearing tokens will be rigorously evaluated for security, use reliable price feeds, and included with appropriate risk limits to mitigate overall protocol exposure (explained below). Including these external sources of yield will bring overall rates higher on the Protocol, and allow for it to outcompete other protocols that have no plan to incentivize deposits when their token reserves run out.

Price Feeds

Prime’s default oracle is Chainlink for all tokens on the platform. To broaden the number of assets supported and offer support for a wider variety of interest bearing collateral, Prime will additionally support Redstone and DIA oracles. It is important to note that just because an oracle exists does not guarantee Prime will list an asset as collateral. Such assets must have a large enough liquidity base to support accurate prices, and be resistant to price manipulation attacks. The protocol additionally sets risk limits to prevent reliance on any single asset too much.

Risk Limits

WIthout proper risk mitigations strategies, a protocol is vulnerable to market gyrations and economic attacks. Liquidity protocols must ensure that the collateral used to back user borrows is always sufficient to protect users who have supplied liquidity. Therefore, Prime Protocol implements a number of risk limits to prevent risky borrowing behavior, both from an individual user and protocol wide perspective.

Collateral Ratios

Collateral ratios are the discount applied to collateral value when determining the amount a user can borrow. A larger discount is applied to riskier collateral, meaning that a user could borrow more against a stablecoin than against a network token. However, all assets have some discount applied because there is always the risk of a depegging or black swan event (see the USDC depegging). Prime uses the idea of maintenance collateral ratios, and initial collateral ratios to determine what a user can initially borrow, and when a user is liquidated. Initial collateral ratios (what a user can initially borrow) are always more stringent than maintenance because a user should not be allowed to borrow an amount leading to immediate liquidation.

Collateral ratios (the ratio a user must maintain to avoid being liquidated) because it would be bad for users if they received a borrow and were liquidated immediately. Initial collateral ratios can also be used to incentivize healthy use of the protocol while not harming existing borrowers. For example, if too many users are borrowing against a single token, the protocol can lower initial collateral ratios for that token to incentivize a more diversified collateral base. Every token in Prime Protocol has a maximum percentage of the collateral base that it can comprise, and if it exceeds that percentage then no new borrows against that token are allowed. This prevents an attacker from performing a Mango Markets style attack, where the price of a single, less liquid collateral token is pumped temporarily to allow for a user to take oversized borrows in other more liquid tokens. Additionally, requiring that the protocol stay diversified and limiting exposure to less liquid collateral types means that liquidations are easier to perform if many users need to be liquidated at once.

Loan Risk Premiums

While many protocols consider the risk of collateral, they often do not consider the risk of the loanable asset. This is a mistake, and leads to inefficiencies such as collateral ratios that are too low for stablecoin deposits. A large portion of the risk a user incurs when borrowing comes from the value of the borrowed token. If a user borrows GLMR against USDT, and GLMR rapidly appreciates in value, the user could be at risk of liquidation despite the value of their USDT remaining constant. However, depositing USDT and borrowing USDC is significantly less risky, because the risk for USDC is much larger to the downside (a depegging event). Therefore, the user should be able to borrow less GLMR than USDC against a collateral base of USDT. To account for these differences in risk, Prime Protocol uses Loan Risk Premiums. When calculating a user’s health score, riskier assets are assigned a premium which reduces the maximum allowable borrow size.

Liquidations

Liquidations on Prime Protocol are performed by third parties on a first come, first serve basis. The more risky an asset (the lower its maintenance collateral ratio), the larger the incentive is for a liquidator to seize it. Liquidators perform a liquidation by repaying a borrower’s debt, and selecting one of the borrower’s collateral assets to receive as a reward. Liquidators must repay bad debt on the chain it was issued, unless they are repaying a borrower’s CDP position. In that case, it is most advantageous to pay for the liquidation on Moonbeam. After a liquidation is paid for, a transaction occurs on Moonbeam to determine whether the liquidator overpaid or attempted to liquidate a solvent user. If the liquidator overpaid, their excess funds will be returned.

Black Swan and Exploit Protection

Even seasoned DeFi teams have suffered from exploits, whether it be of their own fault or a dependency on a token bridge. Prime Protocol has a multi-faceted approach to security to minimize risk to all our users.

- Minimize reliance on token bridges

- Prime protocol does not use token bridges internally and only relies on generic message passing. This reduces the protocol’s dependency on third party code and therefore minimizes risk from third party integrations. However, in some instances using a wrapped token is necessary (such as USDC.wh). Prime Protocol’s plan is to reduce reliance on these tokens as soon as a native representation is available. Assets such as USDC.wh are also given lower collateral ratios and risk limits than they otherwise might have due to the added risk of the token bridge.

- Contract monitoring and emergency freeze

- Prime Protocol has partnered with Sentio to provide custom real time dashboards and alerting for all our contracts. If any unusual activity were to be identified, the protocol can be frozen either entirely or just borrows can be paused to allow for investigation and resolution into the potential exploit. We are investigating a further partnership with another party to set up a sentinel, which will be able to watch for exploits and react in real time to freeze the protocol and allow for a fix to be developed and pushed.

Security Audits

Prime Protocol has undergone multiple audits by security firms Ackee Blockchain and Veridise Inc. Every part of the codebase has been audited, and we will release four total reports (two from each firm) with their initial audits of the protocol and follow up audits with more recent additions. We are in the process of completing the fourth audit and the auditors indicated to us that they should complete the audit within the next week or two. We received feedback asking about how we would navigate feedback that requires re-working of the protocol architecture. As of our most recent sync with the auditors on March 16th, there have been no vulnerabilities found that would have required a re-working of the protocol. If one should arise, we would dedicate all of our engineering resources to addressing the vulnerability as fast as possible, and conduct a further audit to ensure that nothing new emerged as a result. Security is our highest priority, and we will never deploy unaudited code or contracts without rigorous examination. If our timeline were to be impacted as a result, we would deploy the grant funds starting on a later date. All of the audits conducted will be publicly released with our mainnet announcement, along with contract addresses, technical documentation, and integration guidance.

Plans for Decentralization

We currently do not have a governance token, but in the future we will be taking steps to fully decentralize the protocol. While we have not publicized a token distribution plan, there will be steps taken to ensure users of the protocol are given the opportunity to participate in governance. Governance powers will include the ability to guide which assets and chains are added, risk limit adjustments (within pre-set guardrails), and use of protocol revenue. As the earliest users, the Moonbeam Community will have a special opportunity to become early stakeholders in Prime Protocol.

Timeline and Milestones for Use of Grant

We plan to start use of the grant end of April or early May, after the protocol has been launched and usage has begun. We will continue incentives through at least the end of June for the first tranche. Our vision of success would include:

- $16+ million of TVL on the Moonbeam deployment of Prime Protocol within the first three months of mainnet.

- We aim to see 1,000 weekly active users, with 4,000 users overall on Moonbeam within the first quarter of being live.

- The grant will be released in tranches of 200k GLMR, with the aforementioned ratios set to be the starting allocations. The subsequent tranches will be adjusted to ensure our TVL targets are met, and any extra GLMR will be allocated to the markets with the lowest yields (more TVL per GLMR spent)

Vision of Success

The grand vision of the protocol is to achieve billions of dollar value in TVL across every major EVM ecosystem, and position Prime Protocol as the dominant liquidity protocol in crypto. This growth will be made sustainable through the use of yield bearing assets as collateral, which will allow for yield to be exported from other ecosystems into Moonbeam’s DeFi landscape. Success for Prime Protocol would make every user across crypto a Moonbeam user, because every transaction they submit will be using Moonbeam in the background. The use of Moonbeam as a hub chain will also incentivize users to pay for their transactions using GLMR as gas for faster and cheaper execution.

Rationale

Prime Protocol is a pioneering example of an application building Cross-Chain Connected Contracts. We are the first cross-chain prime brokerage, offering spot margin to users backed by a cross-chain portfolio of assets. Using Moonbeam as a hub, Prime is an application that spans many chains but uses Moonbeam in the background for every transaction. This grant will bring users to the Moonbeam ecosystem and encourage higher TVL on the Moonbeam deployment of Prime Protocol. Ensuring that there is a deep capital base on Moonbeam will allow for more users to enter the Moonbeam Ecosystem through Prime Protocol. By offering more attractive yields on Moonbeam deposits and lower net yields on borrows, users will be incentivized to bridge their collateral to Moonbeam and take their borrows on the chain as well. By being a cross-chain application, Prime will also raise awareness of Moonbeam by bringing users from other ecosystems onto an application which prioritizes Moonbeam in the order of available assets and chains though our UI. These users can easily receive liquidity on Moonbeam and participate in the ecosystem. Additionally, liquidations for all synthetic assets issued by Prime Protocol (including an overcollateralized stablecoin) are performed on Moonbeam, which will attract more liquidity to the ecosystem.

Connected contracts are a main focus for the development of Moonbeam as a dominant chain in the wider crypto ecosystem. Ensuring that the leading examples of this technology are successful will attract many more builders to Moonbeam. To stand out as a leading blockchain to build on, we need to support innovative projects that further the goals of the ecosystem.

Steps to Implement

Implementing this proposal will require funds to be sent to a rewards contract responsible for distributing GLMR tokens to Prime Protocol users. These contracts will allow users to claim rewards for relevant participation in the Prime Protocol Mainnet. Costs associated with this include development and deployment of these contracts, and integration with front end user interfaces. Prime Protocol will be responsible for the development of these contracts. We would expect these funds to be transferred after mainnet has been deployed, the contract addresses are made publicly available, audit reports have been released, and all assets listed in this proposal are available on Moonbeam to deposit/borrow.

Updates:

Community engagement KPIs

More information on team

Security Audit Information

CDP

Money Markets

Costs to Users

Risk Parameters

Black Swan and Exploit Protection

Price Oracles

Message Passing

Sources of Revenue

Hub and Spoke Architecture using Connected Contracts

Liquidations

Sources of Real Yield

Synergies with Moonbeam Ecosystem

On/Off Ramps

Use of Grant

Plans for Decentralization