CHARM FINANCE: Ecosystem Grant Draft Proposal

AUTHOR:

Charm Finance

PRIMARY GOAL:

Maintain and Grow Activity (active users, transactions, TVL)

PROJECT DESCRIPTION:

Charm’s Alpha Vaults is the easiest way to provide and manage liquidity. With 1-click, anyone can create their own LP vault to manage the liquidity in any Uniswap V3 pool.

REQUESTED GLMR GRANT AMOUNT:

2,000,000 GLMR

USE OF GRANT:

2,000,000 GLMR will be used to incentivise the liquidity vaults created by Charm. The vaults’ code and strategy will be open-sourced, so that anyone can use its track record to create their own vaults. When the incentives end, users are more likely to stay because they will have know how to use Moonbeam and Alpha Vaults to earn yields and manage liquidity.

MOTIVATION FOR GRANT AMOUNT:

TVL, LP returns, and liquidity depth are the most important successful factors of a DEX. To increase liquidity depth and LP returns when Uniswap V3 is deployed on Moonbeam, liquidity managers must use Moonbeam to manage liquidity. To increase TVL, liquidity providers must use Moonbeam to provide liquidity. To be sustainable, LPs and managers must not leave after the incentive period ends.

CHARM’S SOLUTION:

Charm will achieve the above by helping others provide and manage liquidity using Alpha Vaults. The long-term outcome is a thriving ecosystem of LPs and managers at Moonbeam, all working synergistically to increase Moonbeam’s TVL, LP returns, and liquidity depth.

PROJECT OVERVIEW & TEAM EXPERIENCE:

Charm Finance is the oldest liquidity manager on Uniswap V3, and the first to launch LP Vaults. The strategy introduced by Alpha Vaults is one of the most widely used within DeFi to manage liquidity; and its effectiveness, safety, and performance have been proven during 2+ years of continuous operation on Mainnet.

Charm’s investors include Coinbase Ventures, Dialectic, and Delphi Ventures, and its team has diverse backgrounds in asset management, trading, software engineering, and legal. The team have been buidling and investing in crypto since 2017.

RELEVANT KPI

The latest version of Alpha Vaults was tested on Mainnet and L2 for 5 months prior to launching on 13th July, and the results are summmarised in the attached. In total, 15 vaults were created, 7 of which are optimised for LP Returns (the Income Vaults), and 8 to increase liquidity depth (the Liquidity Depth Vaults).

With no token incentives:

-

The Income Vaults achieved average Net Returns** of 8% (22% APY)

-

The Liquidity Depth vaults achieved on average 37x better liquidity than Uniswap V2 or a Full-Range position.

**Net Returns = Fees Earned - Impermanent Loss - Protocol Fees

The following are examples of the LP vaults that can be created using Alpha Vaults:

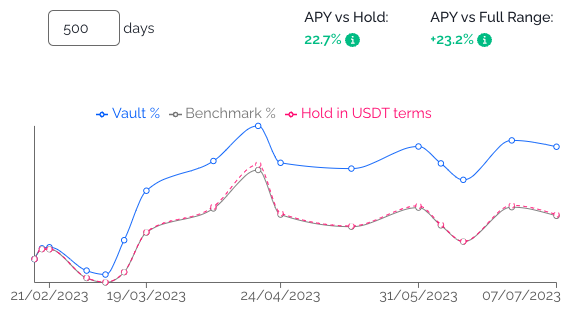

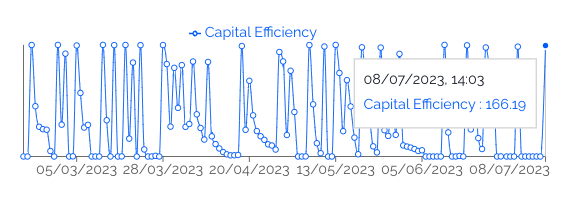

- WETH/USDT 0.05% Vault (example of Income Vault):

– Net Returns: 8.7% over 128 days, 22.7% APY

– Average liquidity improvement: 5.2x better Vs Uniswap V2 or Full-Range

- WETH/UNI 0.3% Vault (example of Liquidity Depth Vault):

– Average liquidity improvement: 55x better Vs Uniswap V2 or Full-Range

– Net Returns: 13.1% over 132 days, with 34.4% APY

The results above were repeated for the other 13 vaults, and show a similar pattern of consistently high APY and liquidity depth with no token incentives.

What this means in practice is that LPs and liquidity managers are more likely to use the vaults when the incentives end. They are also more likely to use Moonbeam and Alpha Vaults to create similar vaults.

USE OF GRANT

The grant will be used to incentivise vaults created by Charm using Alpha Vaults after Uniswap V3 deploys on Moonbeam. The vaults will be chosen based on the expected interest within the Moonbeam community, and after consultation with key stakeholders such as the Moonbeam Foundation and OpenBlocks. Prior to launch, the vaults will be backtested and the results shared with the Moonbeam community.

The incentives will be distributed over a 6 month period from the date of the first Moonbeam LP vault created using Alpha Vaults, and ALL the GLMR tokens will be allocated across the vaults. All LPs depositing into the vaults will be eligible for the rewards.

The vaults’ strategy will be open sourced and explained in plain English, so that LPs and liquidity managers understand how to use the strategy to create their own LP vaults.

VISION OF SUCCESS

The vision is that after the 6 months incentive period, Moonbeam will be have an active ecosystem of LPs and vault managers providing and managing liquidity on Uniswap V3. The metrics to measure success are:

- Total TVL of the vaults created using Alpha Vaults

- Number of vaults created

- Improvement in liquidity depth of the vaults created

- LP Net Returns

- Number of pools where an Alpha Vaults is created

- Number of projects using Alpha Vaults to manage liquidity

SUSTAINABILITY

The goal of the incentives is to show Moonbeam users how they can use Alpha Vaults to generate yields and manage liquidity on Uniswap V3, so that after the incentive period ends, they can use the skills they acquire to create their own vaults at Moonbeam.

RATIONALE

The ecosystem grant will add value to the Moonbeam Ecosystem by maintaining and growing activity (active users, transactions, TVL), because its primary purpose is to build a track record others can use to create their own vaults to provide and manage liquidity.

The outcome is a thriving ecosystem of independent LPs and liquidity managers at Moonbeam, all working together to increase Moonbeam’s active users, transactions, and TVL.

STEPS TO IMPLEMENT

If the proposal is approved, all the GLMR incentives will be used to incentivise LPs in the vaults created by Charm. Over the incentive period of 6 months, regular will be provided to the Moonbeam community on the success metrics outlined earlier.

[Update]

– The latest version of Alpha Vaults was launched. Links changed to reflect this.

– Removed references to specific pools, as these will be determined closer to Uniswap V3 deployment, and following further consultations with the Moonbeam community.