Beamswap’s Moonriver Ecosystem Grant Draft Proposal

By Beamswap Team

Primary Goal

The primary goal of the present proposal is to restart and grow the Moonriver ecosystem through Beamswap initiatives and strategic partnerships. Beamswap’s track record has proven that core stats such as active users, transactions, and TVL could be increased. The previous grant request Beamswap proposed on Moonbeam has also achieved all predicted metrics.

Project Description

Beamswap is a Moonbeam-based DeFi hub powered by standard, stable & CL AMM, providing liquidity for peer-to-peer transactions. Beamex by Beamswap is the only active perpetual exchange on Polkadot.

Requested Grant Amount

The proposal asks for 47,000 $MOVR for liquidity incentives and $150,000 for the platform’s V3 development over one year ($200,000 for two years).

Use of Grant

47,000 $MOVR would be used to increase concentrated liquidity on upcoming liquidity AMM, leading to a stronger influx of new and existing users on the Moonriver Network. Rewards will be linearly distributed over six months. With $150,000 in development funding, Beamswap plans to onboard a new liquidity managing partner.

Motivation for Grant Amount

Maintaining a native DEX with an active development and marketing team should be the focal point before any restart programs or ecosystem grants come into play. Fostering liquidity for Moonriver’s native asset, $MOVR, should be the priority and a starting point, along with integrating an active stablecoin bridge from Axelar. Accessibility to a native market would also represent an entry point for new builders and their project tokens.

The primary goal of the present proposal is to restart and grow the Moonriver ecosystem through Beamswap initiatives and strategic partnerships. Beamswap’s track record has proven that core stats such as active users, transactions, and TVL could be increased. The previous grant request Beamswap proposed on Moonbeam has also achieved all predicted metrics.

Decent liquidity depth is necessary for the network to start progressing among active chains and on leaderboards such as DefiLlama. Concentrated Liquidity is a core product that ensures increased capital efficiency compared to v2 platforms like Solarbeam or Huckleberry. It delivers higher asset utilisation, high efficiency, low slippage on all trading pairs, and sustainability via default fee sharing. For example, $200,000 worth of $MOVR on Beamswap would equal $1.8M on Solarbeam.

Consequently, much fewer resources would need to be allocated to the exchange in ecosystem grants. Implementing Axelar and Squid would make $MOVR accessible from all supported swap networks (cross-chain swaps).

Development Cost Breakdown

Considering everything above, a conservative estimate of development costs for one year totals $150,000. Costs would be shared between both parties and would not be solely paid by Moonriver. All marketing-related expenses would fall on Beamswap - except any agreements occurring at a later stage or joint campaigns across the whole network.

The Beamswap team proposes a 2-year agreement between Moonriver and Beamswap for a total of $200,000 ($8,333.3 per month for 24 months) to ensure continuous development and updates of the newly launched Moonriver exchange.

Conservative cost breakdown:

| Description | Costs |

|---|---|

| Front-end development and deployment | $20,000 |

| Back-end development and deployment | $30,000 |

| Partner liquidity farming engine with lifetime support | $40,000 |

| Other infrastructure costs, one year | $10,000 |

| Additional full-stack developer hire, one year | $30,000 |

| Audit via SourceHat or Peck Shield | $20,000 |

| TOTAL | $150,000 |

Beamswap’s product suite would include the following key areas:

- Concentrated Liquidity v3 with external engine

- AMM DEX

- CLMM DEX with Stable AMM support

- LSD native exchange token staking

- Community projects liquidity (no listing fee)

- Cross-chain swap capability

- Axelar bridge integration

- Advanced router with Squid

- Launchpad (if needed)

The essential costs outline deployment of Concentrated Liquidity v3 Engine (Algebra cannot be integrated due to StellaSwap holding a Polkadot license) and partner liquidity farming engine to deliver a seamless farming experience to farmers and allow them to farm grants (e.g., Gamma on Moonbeam). The team would also onboard an additional full-stack developer to oversee the Moonriver ecosystem and future partner integrations, plus another hire to keep up with network updates and promote possible integrations. Solutions like Uniswap v4 and future releases will require significant investment of time, resources, and costs.

Updates: Reserved

Project Overview and Relevant KPIs

The Beamswap DeFi Hub is among the five leading players in the Moonbeam DeFi arena, according to Web3Go, DappRadar, and Moonbeam Subscan. The continuous development and upgrades in the past two years have led Beamswap to the top dapp category, listed among/as:

- Top 3 dapps by transactions on Moonbeam

- Top 5 dapps by active addresses on Moonbeam

- Top 3 dapps by number of unique active wallets on Moonbeam

- 12,000 holders of the Beamswap-native $GLINT token on the Moonbeam network

- 1st perpetual DEX on Polkadot

- 1st perpetual DEX hitting $70,000,000 in volume

Notable deliveries have included v3 of DEX AMM, Yield Farming on Polkadot, the first Launchpad on Polkadot, Stable AMM, decentralized perpetual futures trading on Beamex, cross-chain swaps via Squid and Swing, YieldBooster governance, as well as countless router and UI/UX updates. The full list and description of all products and features can be found on Beamswap’s Documentation page hosted on GitBook.

During the platforms’ operation on Polkadot, the Beamswap team has successfully applied for and was awarded two grant programs on Moonbeam:

Both times, the grants delivered successful results despite unfavourable market conditions.

TVL and APY Estimates & General Thoughts

Considering the prevailing market conditions and the current state of Kusama and the Moonriver Network, Beamswap believes that the foundation deploying $1,750,000 worth of $MOVR as incentives over the next six months is a justifiable amount. Given the operational dynamics of the network, the proposal recommends allocating the majority of these funds towards a single decentralized exchange (DEX) and lending platform, namely Moonwell.\

Moonwell’s substantial audience, particularly on Base, positions it as a pivotal player in revitalizing Moonriver. Drawing from the lessons of Moonbeam Ignite #1, dispersing funds across multiple platforms risks diluting impact rather than enhancing it. Hence, the proposal suggests allocating $650,000 worth of $MOVR to Moonwell and one exchange, ensuring the establishment of a robust network for borrowing and trading. The remaining $450,000 should be earmarked for projects interested in building on or migrating to the network, with a cap of $100,000 per participant. This strategy fosters a competitive environment conducive to development and network presence.

To assess the proposal’s success, three key metrics would be tracked:

- MoonriverDEX v3 TVL

- MoonriverDEX monthly volume

- MoonriverDEX 30-day transactions

The main pools where most incentives should be allocated would be xcKSM, MOVR, and the native stablecoin pool. Further incentives should go to vested tokens provided by Bifrost. This would ensure that swaps up to $100,000 and liquidations for Moonwell can happen without a significant price impact. The following pairs would be considered:

- MOVR - xcKSM

- MOVR - axlUSDC

- 3-pool: axlUSDC, axlUSDT, FRAX

- xcKSM - xcvKSM

- MOVR - vMOVR

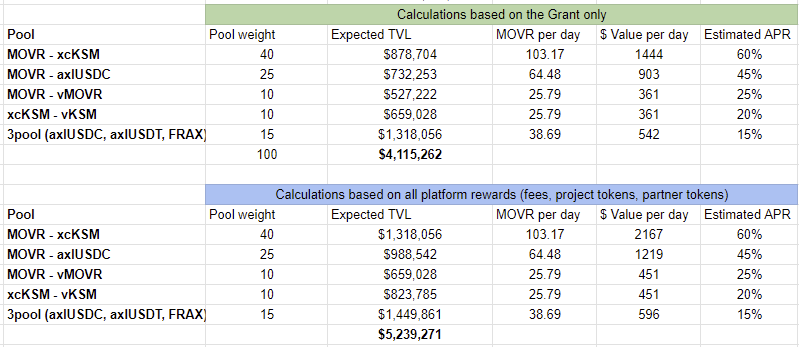

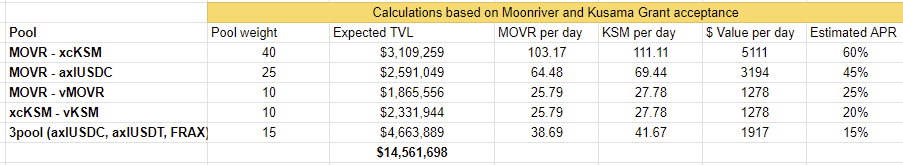

Below are conservative TVL calculations based on the 47,000 $MOVR rewards for a 6-month period, distributed evenly every month.

The $4 Million in TVL would represent a significant step forward for a deep liquidity book, allowing it to handle swaps of up to six figures without major slippage. In collaboration with Moonwell and Bifrost, Beamswap could achieve at least $20,000,000 to $25,000,000 in TVL. This would be a powerful stepping stone for the Kusama and Moonriver ecosystem.

Everyone could benefit from the collective ecosystem by making a request to Kusama OpenGovernance forums and taking advantage of the funding.

Below is a calculation based on the grant funding of 50,000 $KSM tokens.

Vision Of Success

Beamswap’s vision is to establish a base amount of liquidity on the Moonriver network, allowing institutional and retail users to execute strategies with higher efficiency but lower fees and slippage.

Marketing Efforts

The whole marketing strategy would be put in place once the development grant is approved. The team has been considering various options, such as:

- Reactivating the network via token airdrop to all active projects on Moonriver

- Moonriver Collators airdrop, working proposals

- Developing point farming solutions such as Blast, Ethena, and EigenLayer

- Submitting a proposal on Kusama OpenGov

- Moonbeam: R E S T A R T with all future grant recipients

- Leveraging and incentivizing the Moonbeam community

- Free gas by reimbursing the first transaction gas costs in the first month after launch via Beamswap Faucet

- Protocol revenue sharing via LSD token, similar to stGLINT

- No listing fees for new projects

The final marketing strategy and executed campaigns would likely be a combination of the options above. The major catalysts would be points and Moonriver grants for their specific focus on onboarding new users and reaching certain levels of TVL. An external marketing agency would likely be hired to enhance the campaign strategy and marketing efforts. Axelar integration would also make the dapp accessible from various EVM networks.

Rationale

Maintaining a native DEX with an active development and marketing team should be the focal point before any restart programs or ecosystem grants come into play. Fostering liquidity for Moonriver’s native asset, $MOVR, should be the priority and starting point along with integrating Axelar’s active stablecoin bridge. The access to a native market would represent an entry point for builders and their project tokens.

Considering the deployment of Beefy, a light client Ethereum-based bridge, it would be a great opportunity to have everything live to kickstart the new Moonriver DeFi growth and restart the campaign.

Steps to Implement

The approximate timeline to deploy the basic version of Beamswap Moonriver DEX would coincide with the Axelar bridge launch and release of Moonriver Grants. Beamswap’s test deployment would be ready within one month of grant approval. The first deployment would feature Beamswap v3 functionality with StableAMM, Axelar bridge integration, Launchpad, and cross-chain swaps. After that, the solution would undergo continuous upgrades with features including Governance, Community Project Farming, and Advanced Routing.

The incentives and implementation should thus go live towards the end of the second quarter of 2024.

Proposal can also be seen in other format on the following link: Beamswap Moonriver Proposal #1 - Google Docs